1341 Form - Internal revenue code (irc) section 1341 repayment credit is one of the two options that a taxpayer has (the other. It ends up on line 13b of schedule 3 (2024). Enter the credit amount you calculated on line d, claim of right, irc 1341 credit for repayments of prior year income. The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit. The rules for claim of right repayment under irc 1341 depend on the year the income was received and the year of repayment. Select item e, claim of right under irc 1341 for repayments. All entries that seem like you.

It ends up on line 13b of schedule 3 (2024). The rules for claim of right repayment under irc 1341 depend on the year the income was received and the year of repayment. Internal revenue code (irc) section 1341 repayment credit is one of the two options that a taxpayer has (the other. Enter the credit amount you calculated on line d, claim of right, irc 1341 credit for repayments of prior year income. All entries that seem like you. The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit. Select item e, claim of right under irc 1341 for repayments.

It ends up on line 13b of schedule 3 (2024). The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit. Select item e, claim of right under irc 1341 for repayments. All entries that seem like you. Enter the credit amount you calculated on line d, claim of right, irc 1341 credit for repayments of prior year income. Internal revenue code (irc) section 1341 repayment credit is one of the two options that a taxpayer has (the other. The rules for claim of right repayment under irc 1341 depend on the year the income was received and the year of repayment.

2023 Form IRS 1041T Fill Online, Printable, Fillable, Blank pdfFiller

Select item e, claim of right under irc 1341 for repayments. The rules for claim of right repayment under irc 1341 depend on the year the income was received and the year of repayment. All entries that seem like you. Enter the credit amount you calculated on line d, claim of right, irc 1341 credit for repayments of prior year.

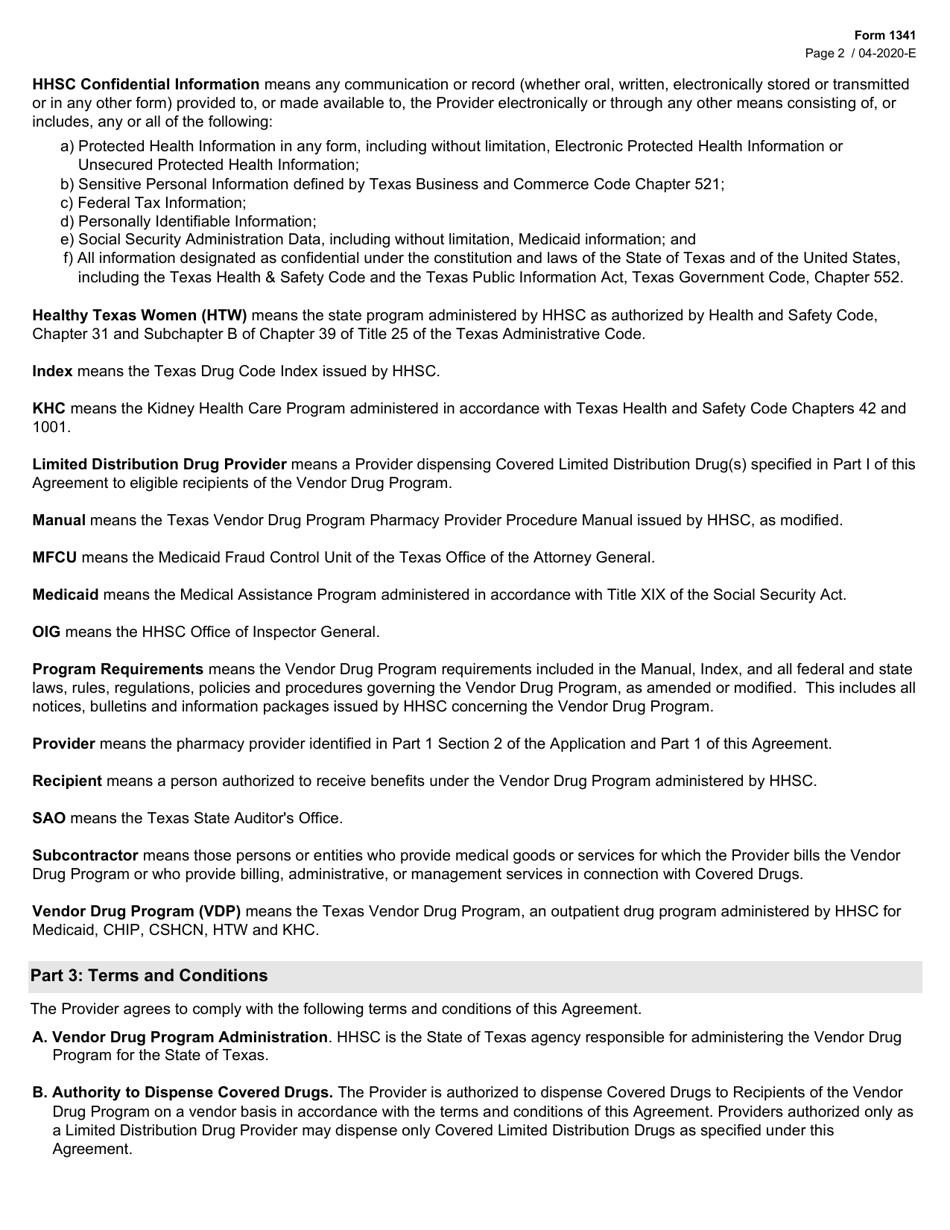

Form 1341 Fill Out, Sign Online and Download Fillable PDF, Texas

The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit. Select item e, claim of right under irc 1341 for repayments. It ends up on line 13b of schedule 3 (2024). All entries that seem like you. The rules for claim of right repayment under irc 1341 depend on the.

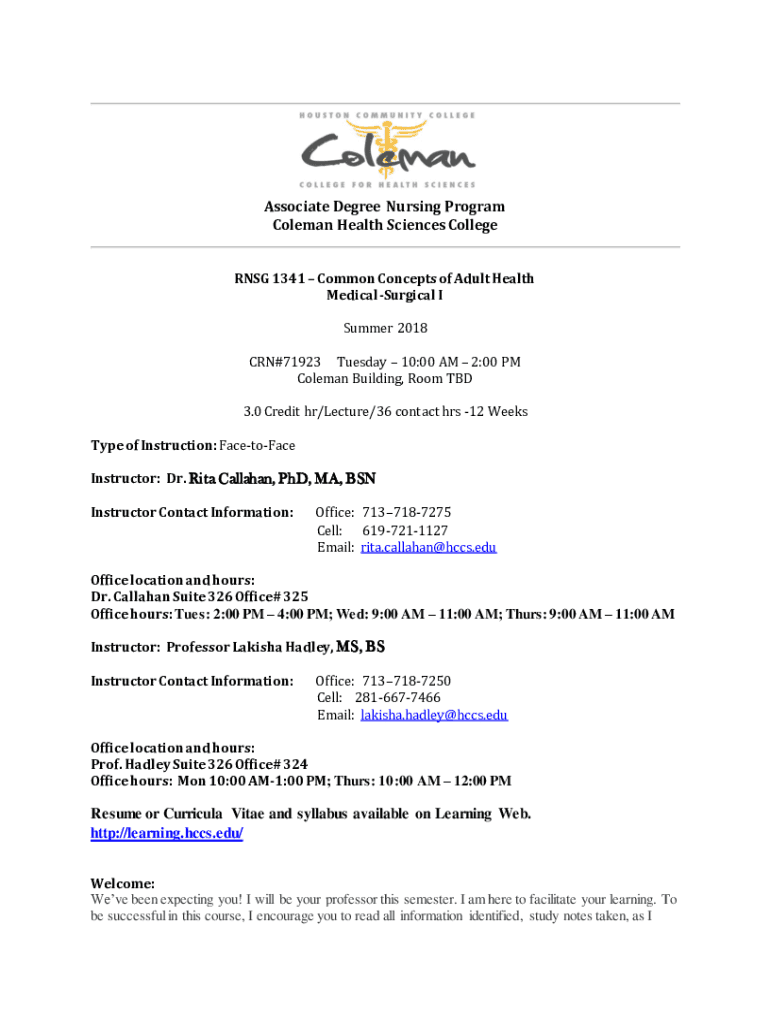

Fillable Online RNSG 1341 HCC Learning Web Houston Community

Enter the credit amount you calculated on line d, claim of right, irc 1341 credit for repayments of prior year income. It ends up on line 13b of schedule 3 (2024). All entries that seem like you. The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit. Internal revenue code.

Dependent Care Worksheets Library

Select item e, claim of right under irc 1341 for repayments. The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit. Enter the credit amount you calculated on line d, claim of right, irc 1341 credit for repayments of prior year income. All entries that seem like you. Internal revenue.

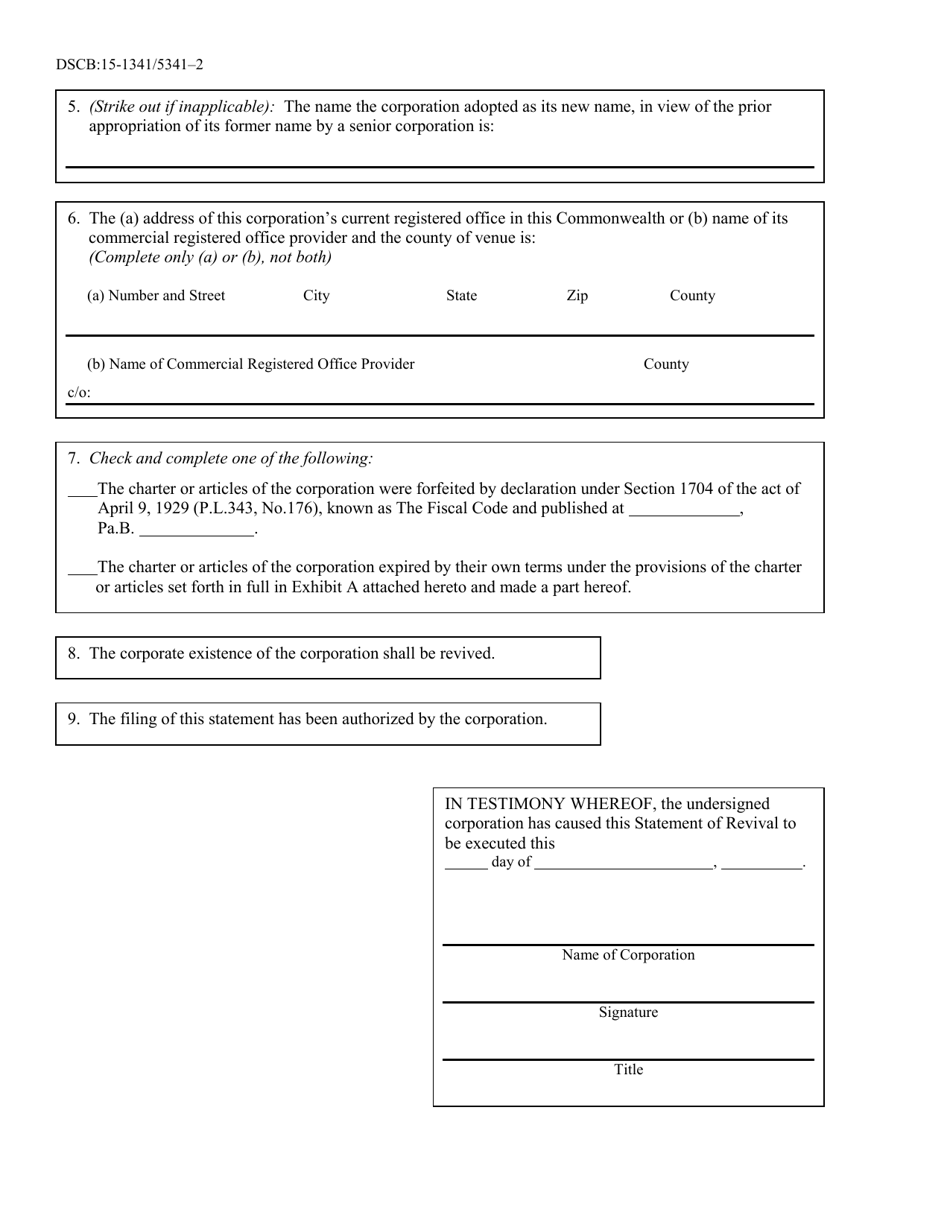

Form DSCB151341/5341 Fill Out, Sign Online and Download Fillable

Internal revenue code (irc) section 1341 repayment credit is one of the two options that a taxpayer has (the other. All entries that seem like you. Select item e, claim of right under irc 1341 for repayments. The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit. The rules for.

Solved What is the IRC 1341 repayment credit in layman's terms?

Enter the credit amount you calculated on line d, claim of right, irc 1341 credit for repayments of prior year income. The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit. All entries that seem like you. Select item e, claim of right under irc 1341 for repayments. Internal revenue.

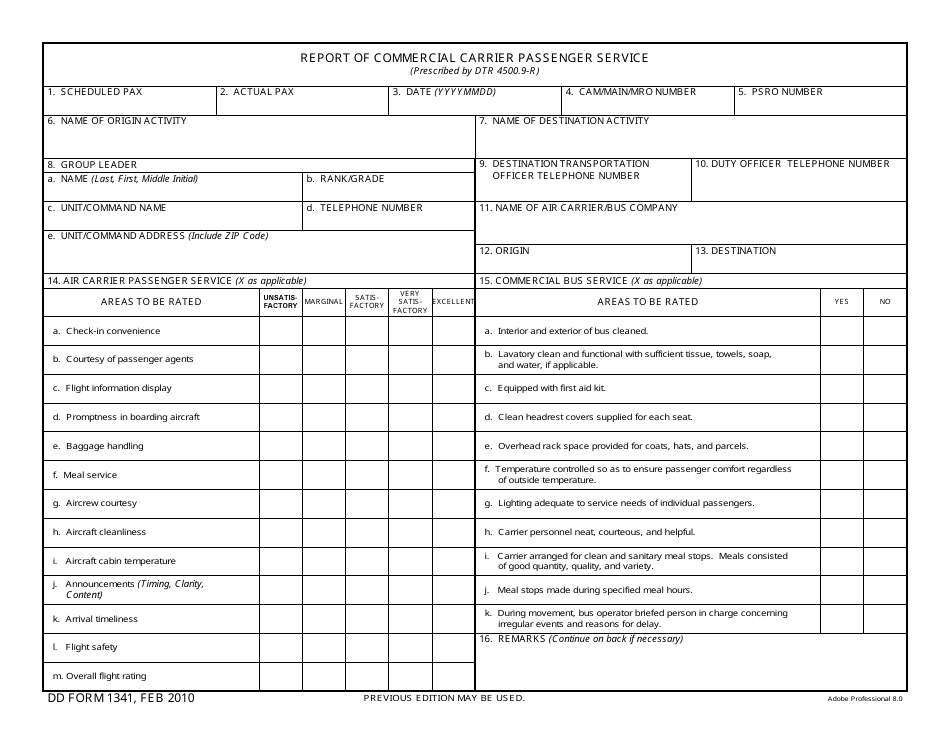

DD Form 1341 Fill Out, Sign Online and Download Fillable PDF

Enter the credit amount you calculated on line d, claim of right, irc 1341 credit for repayments of prior year income. All entries that seem like you. Internal revenue code (irc) section 1341 repayment credit is one of the two options that a taxpayer has (the other. It ends up on line 13b of schedule 3 (2024). The rules for.

Form 1341 Fill Out, Sign Online and Download Fillable PDF, Texas

The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit. It ends up on line 13b of schedule 3 (2024). Internal revenue code (irc) section 1341 repayment credit is one of the two options that a taxpayer has (the other. All entries that seem like you. The rules for claim.

Fillable Online U.S. DOD Form doddd1341 Fax Email Print pdfFiller

The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit. The rules for claim of right repayment under irc 1341 depend on the year the income was received and the year of repayment. It ends up on line 13b of schedule 3 (2024). Internal revenue code (irc) section 1341 repayment.

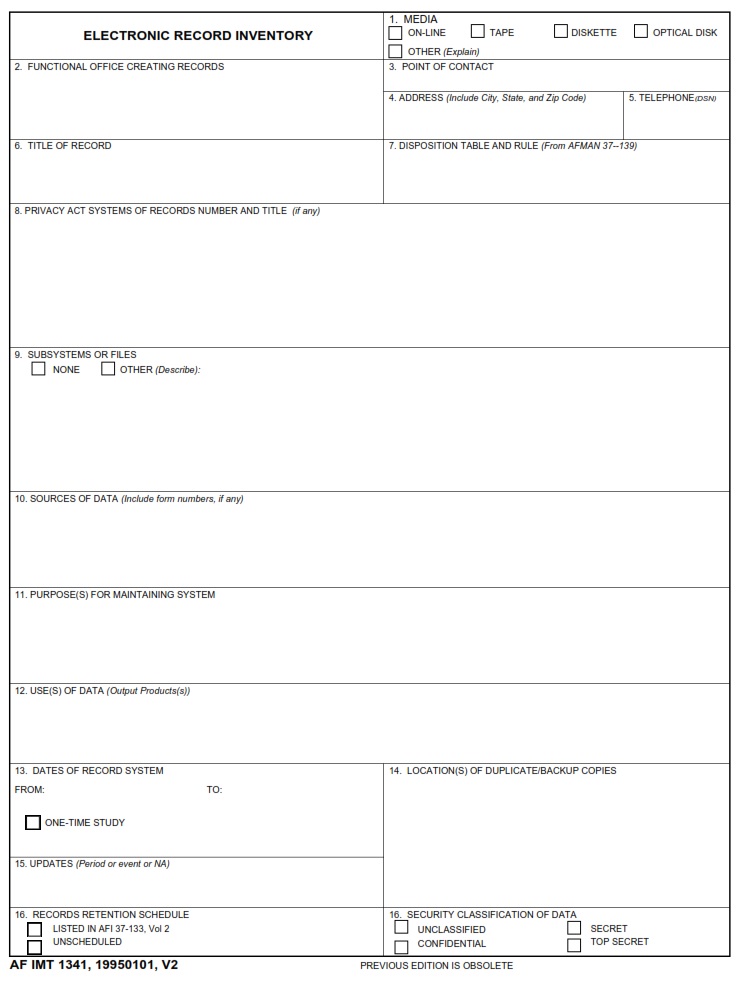

AF Form 1341 Electronic Record Inventory AF Forms

Select item e, claim of right under irc 1341 for repayments. Enter the credit amount you calculated on line d, claim of right, irc 1341 credit for repayments of prior year income. It ends up on line 13b of schedule 3 (2024). All entries that seem like you. Internal revenue code (irc) section 1341 repayment credit is one of the.

Internal Revenue Code (Irc) Section 1341 Repayment Credit Is One Of The Two Options That A Taxpayer Has (The Other.

All entries that seem like you. Select item e, claim of right under irc 1341 for repayments. It ends up on line 13b of schedule 3 (2024). Enter the credit amount you calculated on line d, claim of right, irc 1341 credit for repayments of prior year income.

The Rules For Claim Of Right Repayment Under Irc 1341 Depend On The Year The Income Was Received And The Year Of Repayment.

The claim of right section 1341 credit can be claimed as either an itemized (miscellaneous) deduction or as a credit.