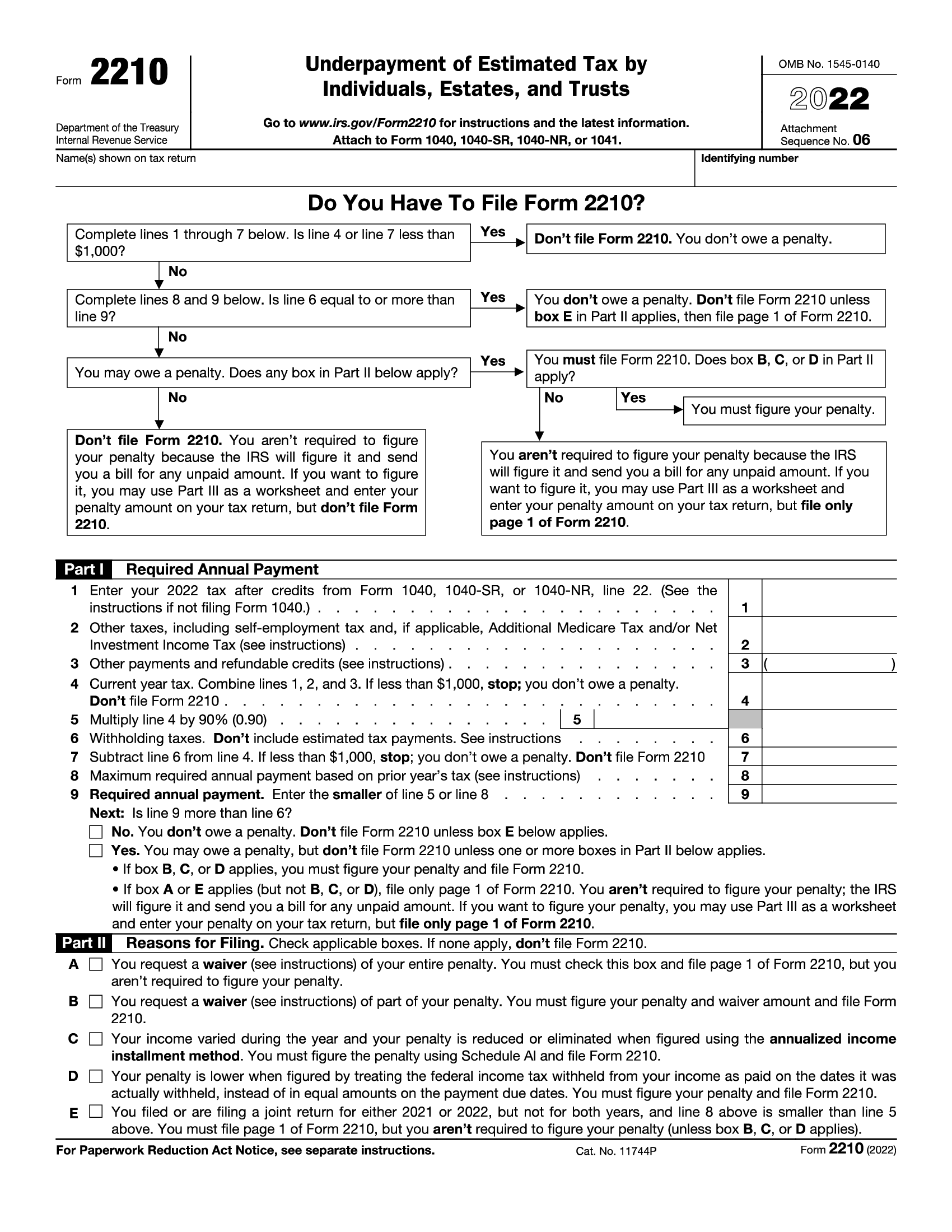

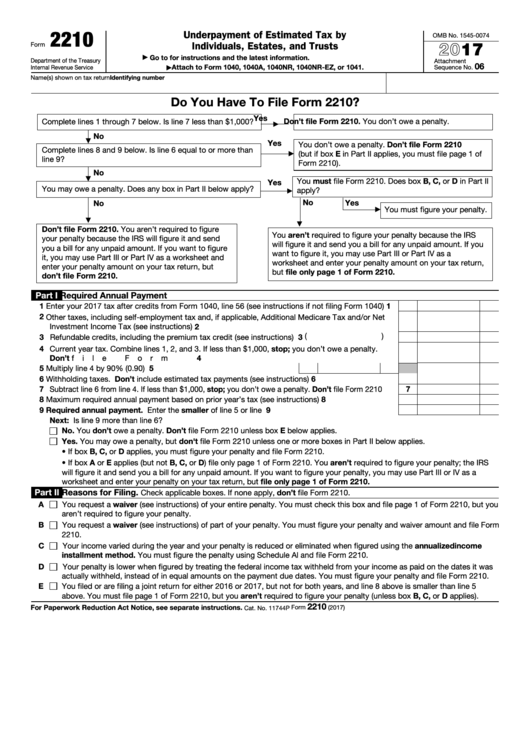

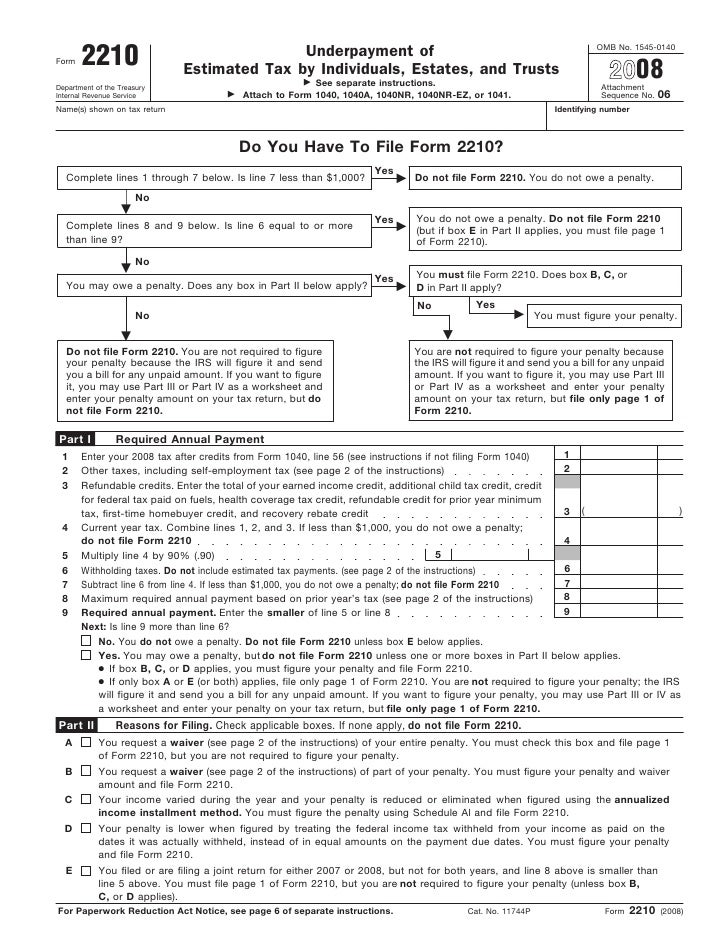

2210 Form - The 2024 federal form 2210 is used by individuals, estates, and trusts to determine if they owe a penalty for underpaying your estimated tax. This is most common with self. What is form 2210 and when do you need to file it? • if box b, c, or d applies, you must figure your penalty and file form 2210. • if box a or e applies (but not b, c, or d), file only page 1 of form 2210. Learn more about when the 2210 form is used, how underpayment penalties work, and how to avoid this penalty in the future. Form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Understand form 2210, its filing requirements, penalty calculations, exceptions,.

The 2024 federal form 2210 is used by individuals, estates, and trusts to determine if they owe a penalty for underpaying your estimated tax. Learn more about when the 2210 form is used, how underpayment penalties work, and how to avoid this penalty in the future. Form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Understand form 2210, its filing requirements, penalty calculations, exceptions,. What is form 2210 and when do you need to file it? This is most common with self. • if box a or e applies (but not b, c, or d), file only page 1 of form 2210. • if box b, c, or d applies, you must figure your penalty and file form 2210.

Understand form 2210, its filing requirements, penalty calculations, exceptions,. • if box b, c, or d applies, you must figure your penalty and file form 2210. This is most common with self. Learn more about when the 2210 form is used, how underpayment penalties work, and how to avoid this penalty in the future. What is form 2210 and when do you need to file it? • if box a or e applies (but not b, c, or d), file only page 1 of form 2210. Form 2210 is used to determine how much you owe in underpayment penalties on your balance due. The 2024 federal form 2210 is used by individuals, estates, and trusts to determine if they owe a penalty for underpaying your estimated tax.

2210 Form 2023 2024

This is most common with self. Form 2210 is used to determine how much you owe in underpayment penalties on your balance due. What is form 2210 and when do you need to file it? Learn more about when the 2210 form is used, how underpayment penalties work, and how to avoid this penalty in the future. • if box.

Irs Form 2210 For 2023 Printable Forms Free Online

This is most common with self. Form 2210 is used to determine how much you owe in underpayment penalties on your balance due. • if box a or e applies (but not b, c, or d), file only page 1 of form 2210. Understand form 2210, its filing requirements, penalty calculations, exceptions,. What is form 2210 and when do you.

IRS Form 2210. Underpayment of Estimated Tax by Individuals, Estates

The 2024 federal form 2210 is used by individuals, estates, and trusts to determine if they owe a penalty for underpaying your estimated tax. This is most common with self. Learn more about when the 2210 form is used, how underpayment penalties work, and how to avoid this penalty in the future. • if box b, c, or d applies,.

Irs Form 2210 For 2023 Printable Forms Free Online

This is most common with self. The 2024 federal form 2210 is used by individuals, estates, and trusts to determine if they owe a penalty for underpaying your estimated tax. What is form 2210 and when do you need to file it? • if box a or e applies (but not b, c, or d), file only page 1 of.

Irs Form 2210 Printable Printable Forms Free Online

This is most common with self. Learn more about when the 2210 form is used, how underpayment penalties work, and how to avoid this penalty in the future. Understand form 2210, its filing requirements, penalty calculations, exceptions,. • if box b, c, or d applies, you must figure your penalty and file form 2210. • if box a or e.

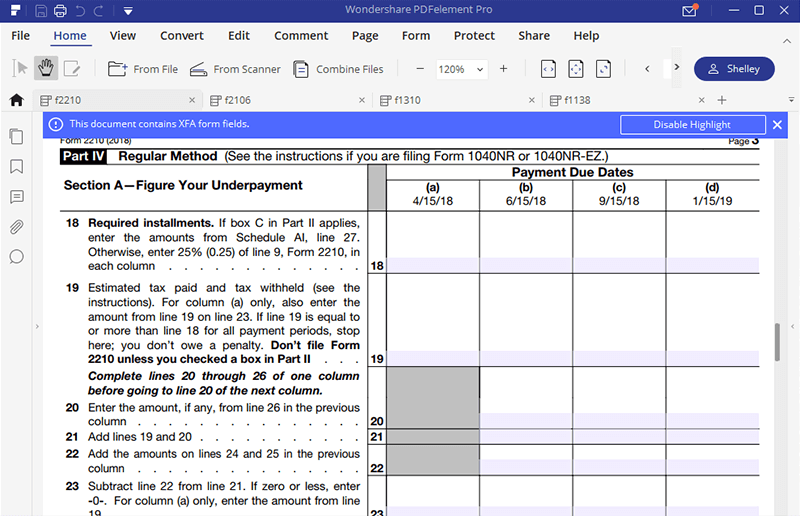

IRS Form 2210Fill it with the Best Form Filler

This is most common with self. What is form 2210 and when do you need to file it? The 2024 federal form 2210 is used by individuals, estates, and trusts to determine if they owe a penalty for underpaying your estimated tax. Form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Understand.

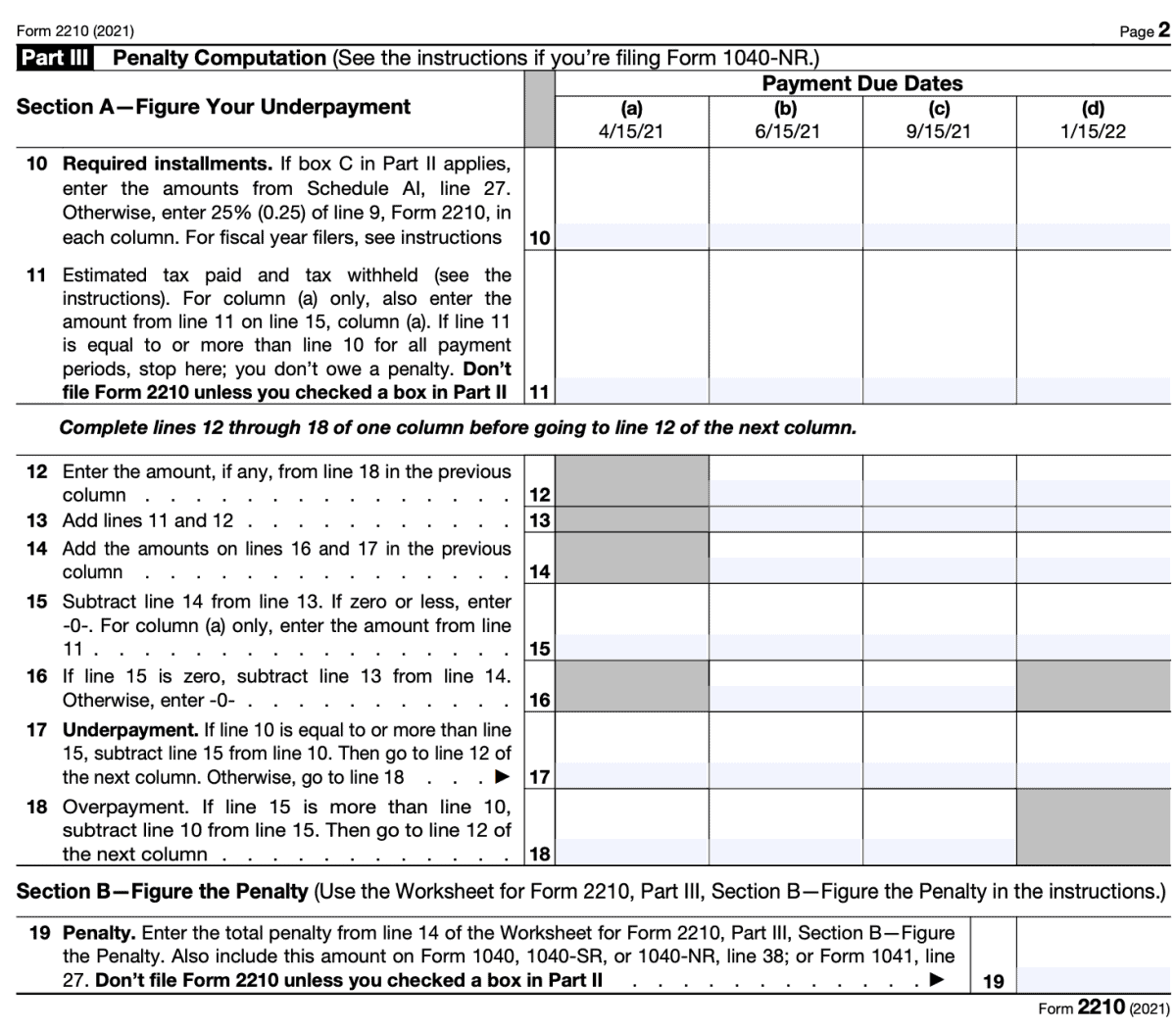

IRS Form 2210 A Guide to Underpayment of Tax

Understand form 2210, its filing requirements, penalty calculations, exceptions,. Learn more about when the 2210 form is used, how underpayment penalties work, and how to avoid this penalty in the future. • if box a or e applies (but not b, c, or d), file only page 1 of form 2210. The 2024 federal form 2210 is used by individuals,.

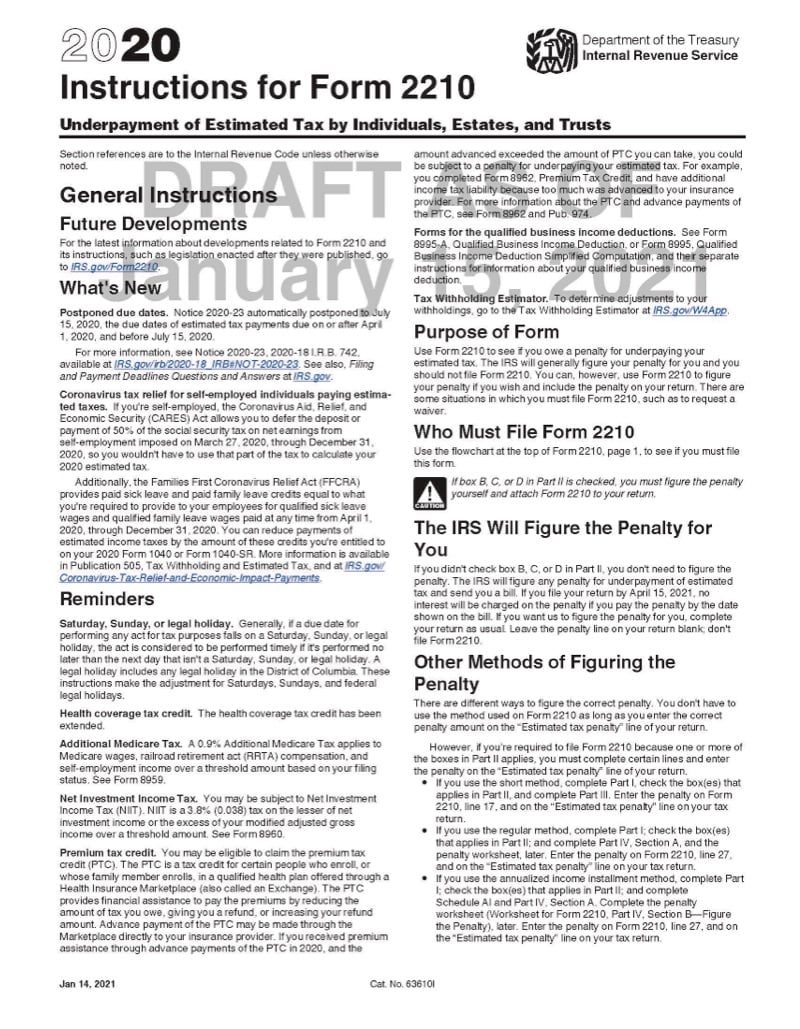

IRS Form 2210 Instructions Underpayment of Estimated Tax

The 2024 federal form 2210 is used by individuals, estates, and trusts to determine if they owe a penalty for underpaying your estimated tax. This is most common with self. Understand form 2210, its filing requirements, penalty calculations, exceptions,. • if box a or e applies (but not b, c, or d), file only page 1 of form 2210. What.

Top 18 Form 2210 Templates free to download in PDF format

This is most common with self. • if box b, c, or d applies, you must figure your penalty and file form 2210. Understand form 2210, its filing requirements, penalty calculations, exceptions,. • if box a or e applies (but not b, c, or d), file only page 1 of form 2210. Form 2210 is used to determine how much.

Form 2210Underpayment of Estimated Tax

The 2024 federal form 2210 is used by individuals, estates, and trusts to determine if they owe a penalty for underpaying your estimated tax. What is form 2210 and when do you need to file it? Understand form 2210, its filing requirements, penalty calculations, exceptions,. • if box a or e applies (but not b, c, or d), file only.

This Is Most Common With Self.

• if box a or e applies (but not b, c, or d), file only page 1 of form 2210. • if box b, c, or d applies, you must figure your penalty and file form 2210. The 2024 federal form 2210 is used by individuals, estates, and trusts to determine if they owe a penalty for underpaying your estimated tax. Form 2210 is used to determine how much you owe in underpayment penalties on your balance due.

Learn More About When The 2210 Form Is Used, How Underpayment Penalties Work, And How To Avoid This Penalty In The Future.

Understand form 2210, its filing requirements, penalty calculations, exceptions,. What is form 2210 and when do you need to file it?