83B Irs Form - How do i report 83 (b) election income on my taxes when it was not included on line 1 of my w2 and my employer is not sending. No money was earned and i did not receive. The company i work for granted some property to me in 2023. I have two questions regarding to the 83(b) election. Last year i paid fair market value for restricted stock and filed an 83(b) election within 30 days. The irs eliminated the need to attach a copy of the 83 (b) election to the recipient’s tax return to property received on or after january 1,. You don't need to do anything special.

Last year i paid fair market value for restricted stock and filed an 83(b) election within 30 days. You don't need to do anything special. The irs eliminated the need to attach a copy of the 83 (b) election to the recipient’s tax return to property received on or after january 1,. I have two questions regarding to the 83(b) election. How do i report 83 (b) election income on my taxes when it was not included on line 1 of my w2 and my employer is not sending. No money was earned and i did not receive. The company i work for granted some property to me in 2023.

The irs eliminated the need to attach a copy of the 83 (b) election to the recipient’s tax return to property received on or after january 1,. Last year i paid fair market value for restricted stock and filed an 83(b) election within 30 days. You don't need to do anything special. The company i work for granted some property to me in 2023. No money was earned and i did not receive. How do i report 83 (b) election income on my taxes when it was not included on line 1 of my w2 and my employer is not sending. I have two questions regarding to the 83(b) election.

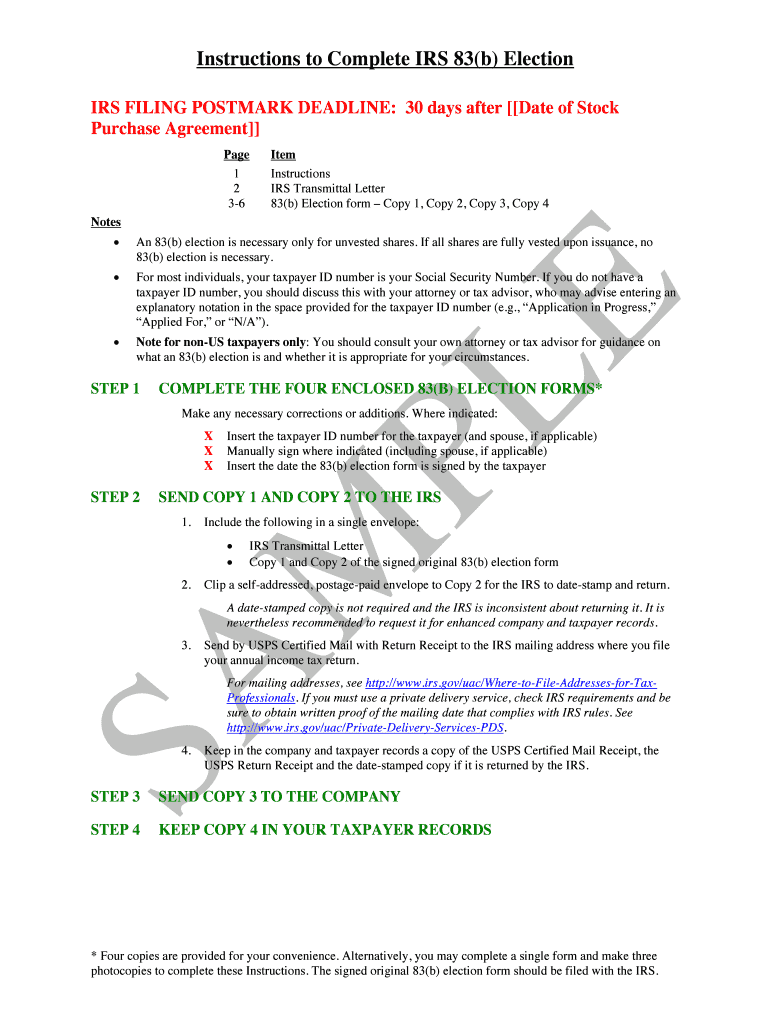

Section 83(b) StepByStep

How do i report 83 (b) election income on my taxes when it was not included on line 1 of my w2 and my employer is not sending. The company i work for granted some property to me in 2023. You don't need to do anything special. No money was earned and i did not receive. The irs eliminated the.

What Is an 83B Election? How and Where to File 83B Election Explained

I have two questions regarding to the 83(b) election. Last year i paid fair market value for restricted stock and filed an 83(b) election within 30 days. You don't need to do anything special. No money was earned and i did not receive. The irs eliminated the need to attach a copy of the 83 (b) election to the recipient’s.

Irs Form 9465 Form Fillable Printable Forms Free Online

No money was earned and i did not receive. The irs eliminated the need to attach a copy of the 83 (b) election to the recipient’s tax return to property received on or after january 1,. The company i work for granted some property to me in 2023. You don't need to do anything special. How do i report 83.

83(b) election — What is an IRS 83(b) election and where to file?

No money was earned and i did not receive. The irs eliminated the need to attach a copy of the 83 (b) election to the recipient’s tax return to property received on or after january 1,. I have two questions regarding to the 83(b) election. You don't need to do anything special. How do i report 83 (b) election income.

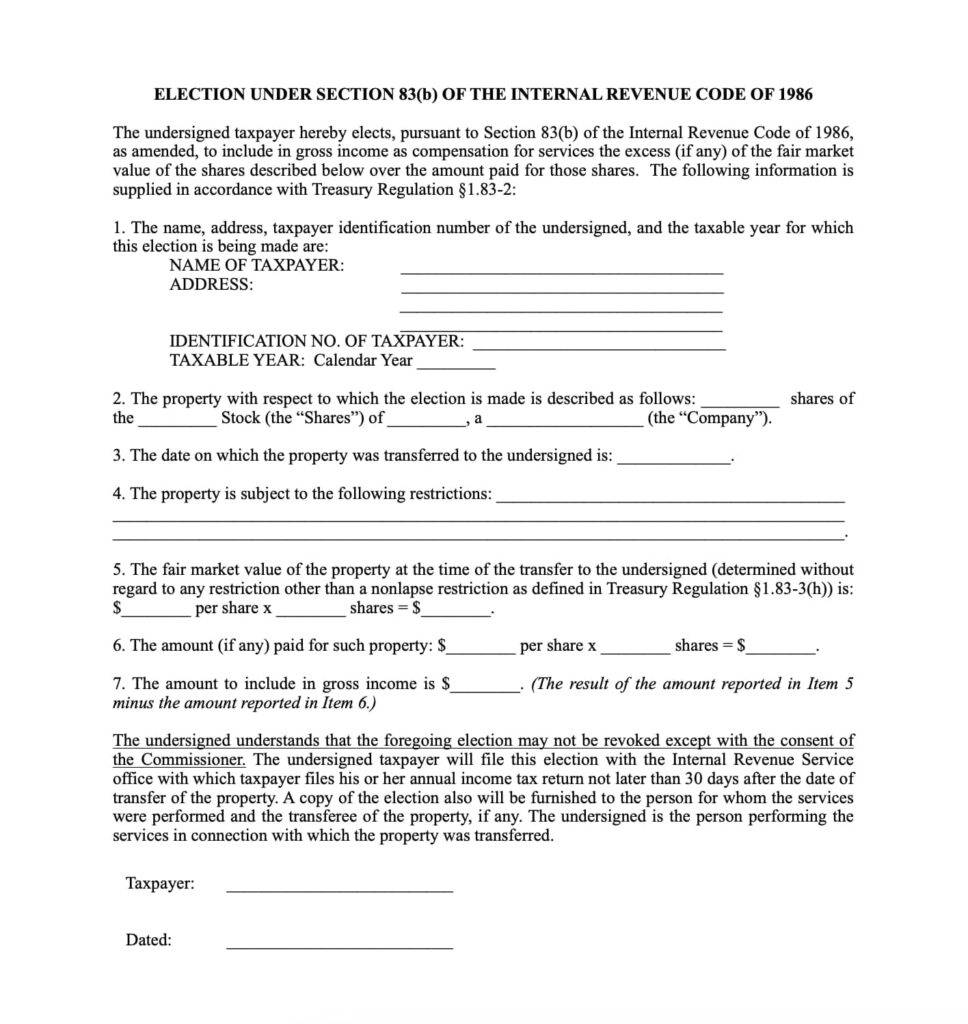

Complete Breakdown of an 83(b) Election Form Example Corpora

Last year i paid fair market value for restricted stock and filed an 83(b) election within 30 days. No money was earned and i did not receive. You don't need to do anything special. How do i report 83 (b) election income on my taxes when it was not included on line 1 of my w2 and my employer is.

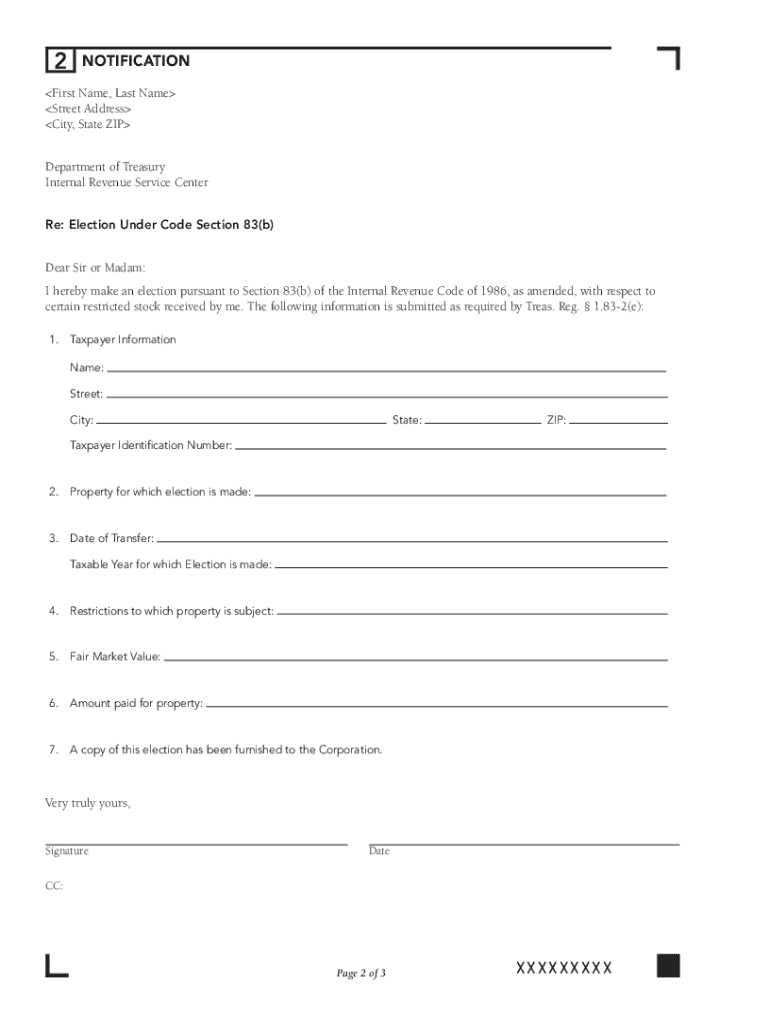

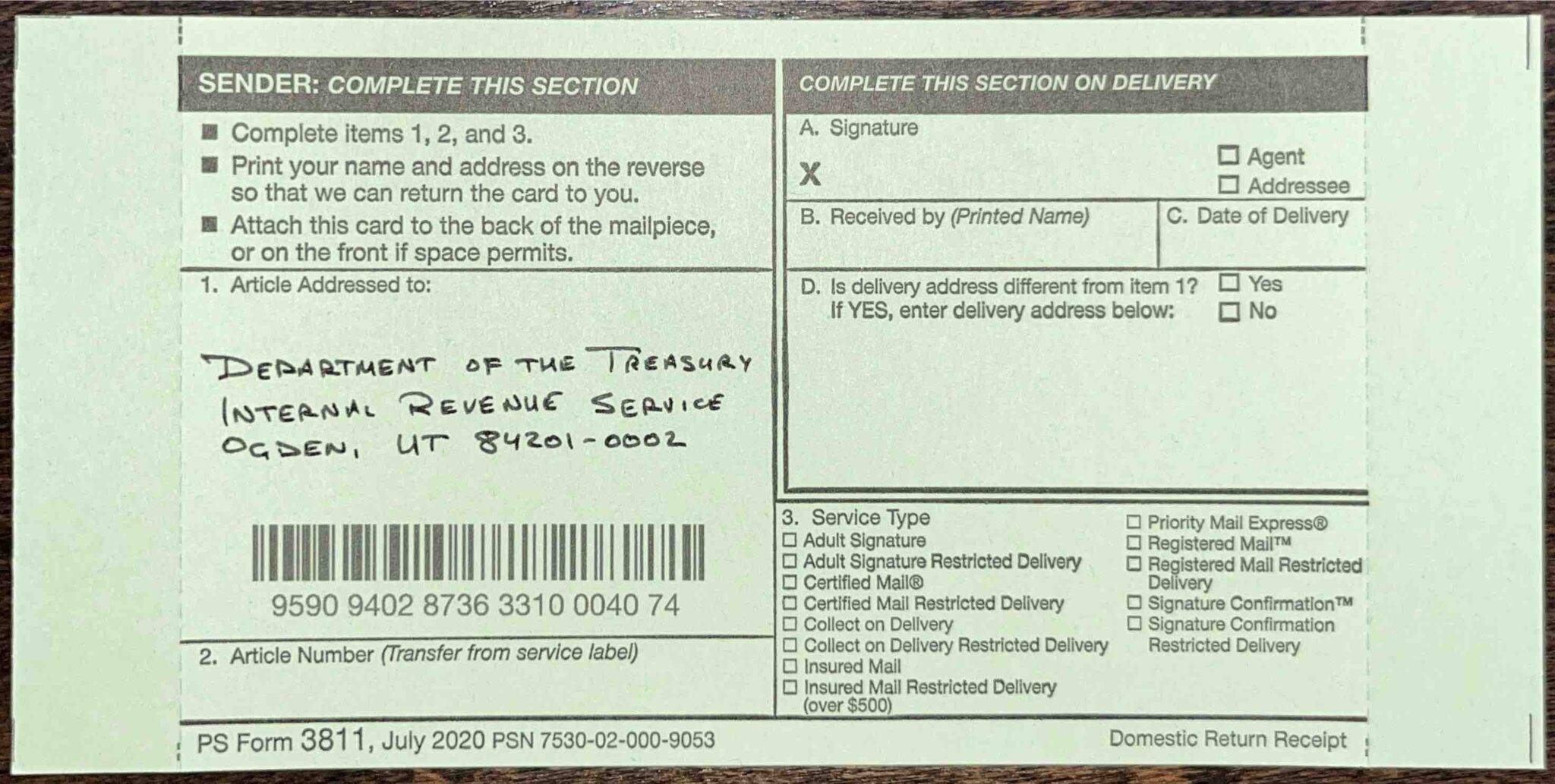

How To File Your 83(b) Election A StepbyStep Guide with Pictures

How do i report 83 (b) election income on my taxes when it was not included on line 1 of my w2 and my employer is not sending. No money was earned and i did not receive. I have two questions regarding to the 83(b) election. Last year i paid fair market value for restricted stock and filed an 83(b).

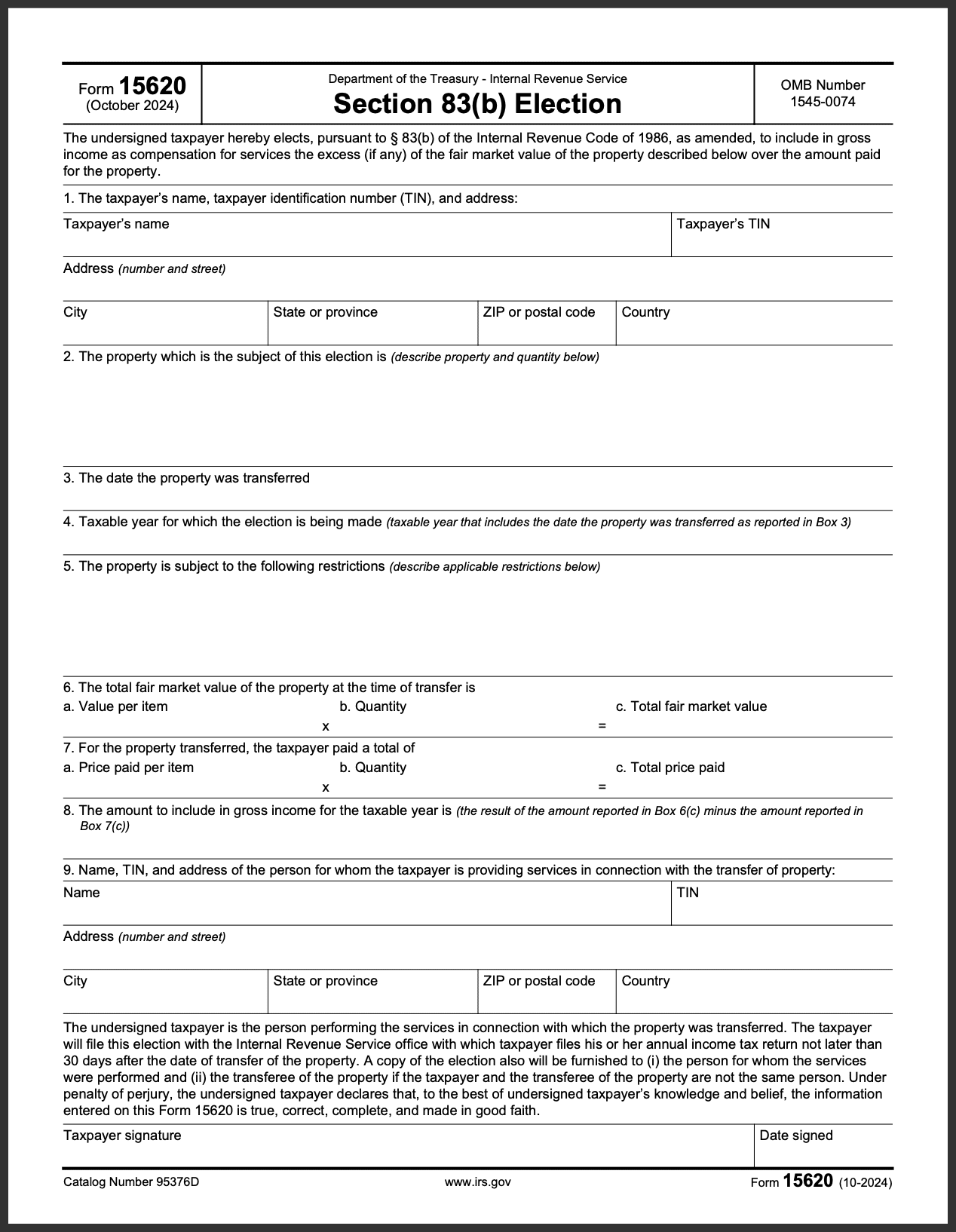

Fillable Irs Form 83b Printable Forms Free Online

Last year i paid fair market value for restricted stock and filed an 83(b) election within 30 days. The irs eliminated the need to attach a copy of the 83 (b) election to the recipient’s tax return to property received on or after january 1,. How do i report 83 (b) election income on my taxes when it was not.

83(b) Election Filings for Early Exercised Option Grants

The irs eliminated the need to attach a copy of the 83 (b) election to the recipient’s tax return to property received on or after january 1,. Last year i paid fair market value for restricted stock and filed an 83(b) election within 30 days. The company i work for granted some property to me in 2023. How do i.

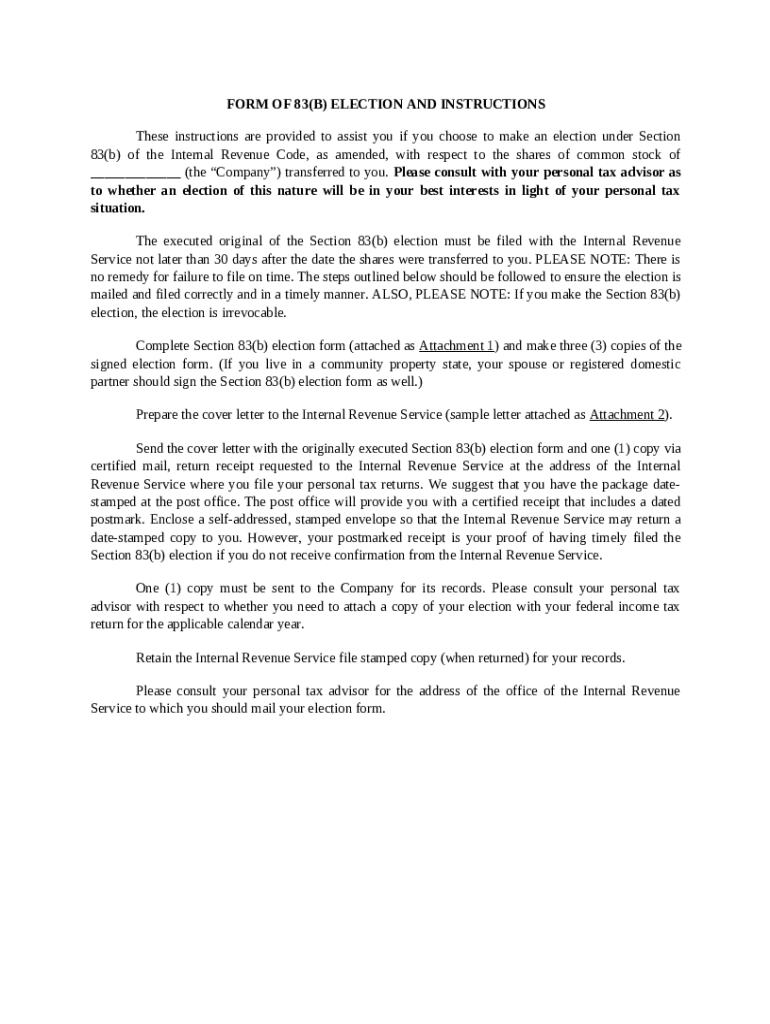

Fillable Online Instructions to Complete IRS 83(b) Election Fax Email

The company i work for granted some property to me in 2023. You don't need to do anything special. How do i report 83 (b) election income on my taxes when it was not included on line 1 of my w2 and my employer is not sending. No money was earned and i did not receive. Last year i paid.

How To File Your 83(b) Election A StepbyStep Guide with Pictures

How do i report 83 (b) election income on my taxes when it was not included on line 1 of my w2 and my employer is not sending. The irs eliminated the need to attach a copy of the 83 (b) election to the recipient’s tax return to property received on or after january 1,. I have two questions regarding.

Last Year I Paid Fair Market Value For Restricted Stock And Filed An 83(B) Election Within 30 Days.

How do i report 83 (b) election income on my taxes when it was not included on line 1 of my w2 and my employer is not sending. The company i work for granted some property to me in 2023. I have two questions regarding to the 83(b) election. No money was earned and i did not receive.

You Don't Need To Do Anything Special.

The irs eliminated the need to attach a copy of the 83 (b) election to the recipient’s tax return to property received on or after january 1,.