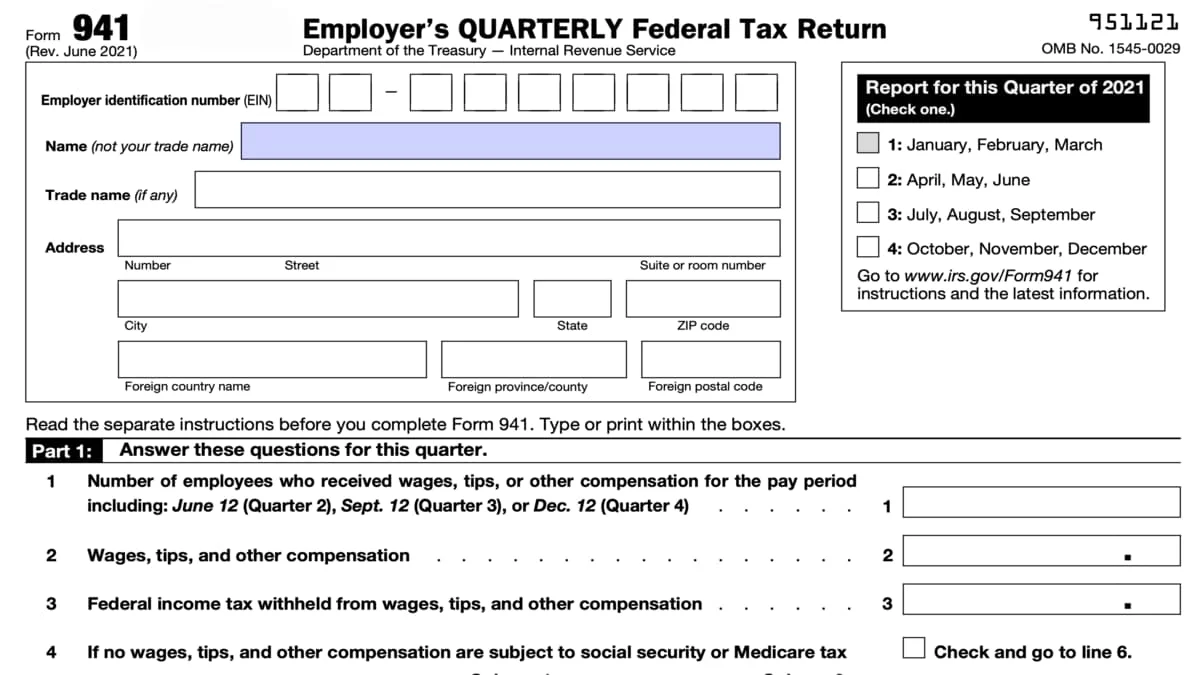

941 Forms - Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. Learn everything about form 941—the employer’s quarterly federal tax return. It also provides space to. Form 941 is one of the most important forms that employers must file, which is also known as the employers quarterly federal tax return. We will use the completed voucher to credit your payment more promptly and. Tax year 2024 guide to the employer's quarterly federal tax form 941. Learn filing essentials, get instructions, deadlines, mailing. Understand who must file, payment methods, due dates, mailing.

Understand who must file, payment methods, due dates, mailing. Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. Tax year 2024 guide to the employer's quarterly federal tax form 941. Learn filing essentials, get instructions, deadlines, mailing. We will use the completed voucher to credit your payment more promptly and. Learn everything about form 941—the employer’s quarterly federal tax return. Form 941 is one of the most important forms that employers must file, which is also known as the employers quarterly federal tax return. It also provides space to.

Learn filing essentials, get instructions, deadlines, mailing. Tax year 2024 guide to the employer's quarterly federal tax form 941. Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. Learn everything about form 941—the employer’s quarterly federal tax return. It also provides space to. Understand who must file, payment methods, due dates, mailing. Form 941 is one of the most important forms that employers must file, which is also known as the employers quarterly federal tax return. We will use the completed voucher to credit your payment more promptly and.

IRS Form 941. Employer’s QUARTERLY Federal Tax Return Forms Docs 2023

It also provides space to. Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. Tax year 2024 guide to the employer's quarterly federal tax form 941. Learn filing essentials, get instructions, deadlines, mailing. We will use the completed voucher to credit your payment more promptly and.

Form 941 template ONLYOFFICE

Tax year 2024 guide to the employer's quarterly federal tax form 941. Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. It also provides space to. Learn everything about form 941—the employer’s quarterly federal tax return. We will use the completed voucher to credit your payment more promptly.

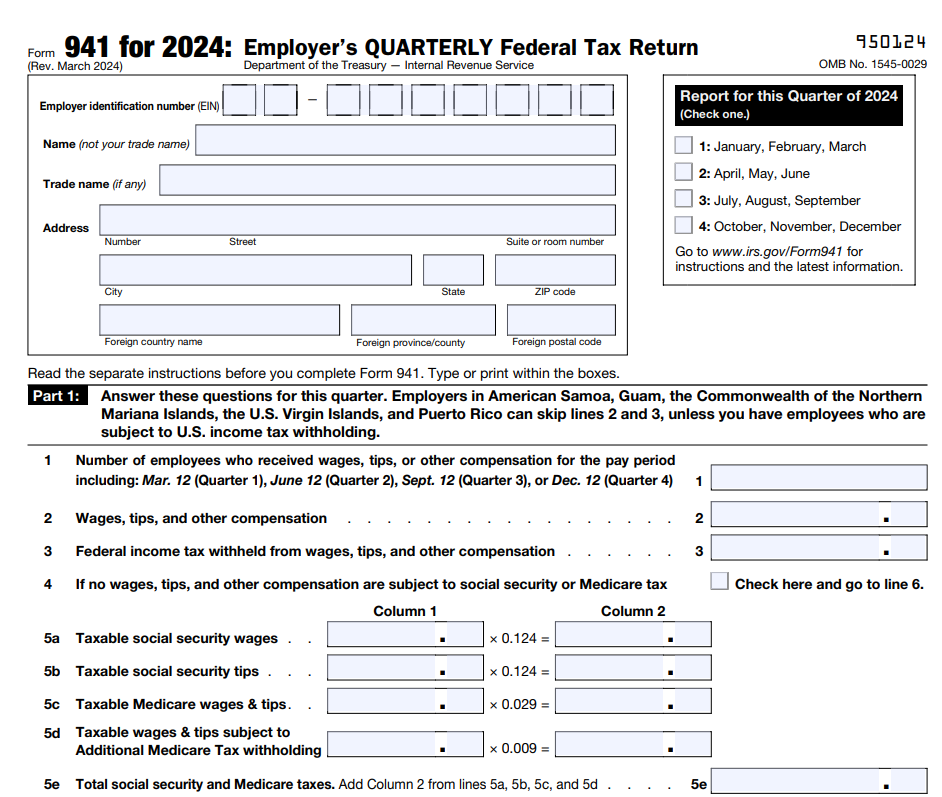

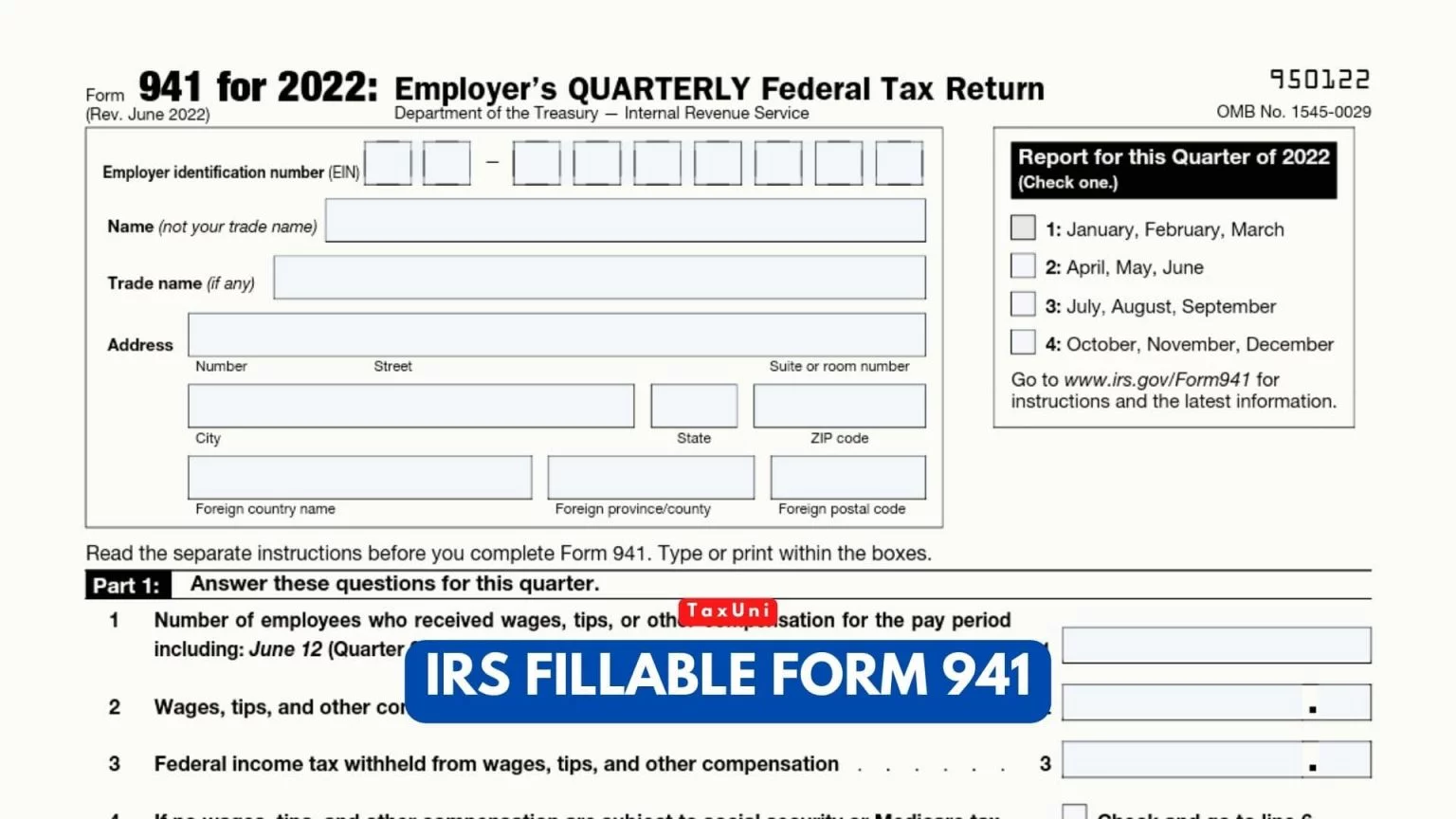

IRS Fillable Form 941 2025

Tax year 2024 guide to the employer's quarterly federal tax form 941. Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. Learn filing essentials, get instructions, deadlines, mailing. We will use the completed voucher to credit your payment more promptly and. Understand who must file, payment methods, due.

Irs Form 941 For 2025 Daniel M. Freeling

We will use the completed voucher to credit your payment more promptly and. Understand who must file, payment methods, due dates, mailing. It also provides space to. Learn filing essentials, get instructions, deadlines, mailing. Learn everything about form 941—the employer’s quarterly federal tax return.

Fillable IRS Form 941 Printable PDF Sample FormSwift

Understand who must file, payment methods, due dates, mailing. Form 941 is one of the most important forms that employers must file, which is also known as the employers quarterly federal tax return. It also provides space to. Tax year 2024 guide to the employer's quarterly federal tax form 941. Irs form 941 is the form your business uses to.

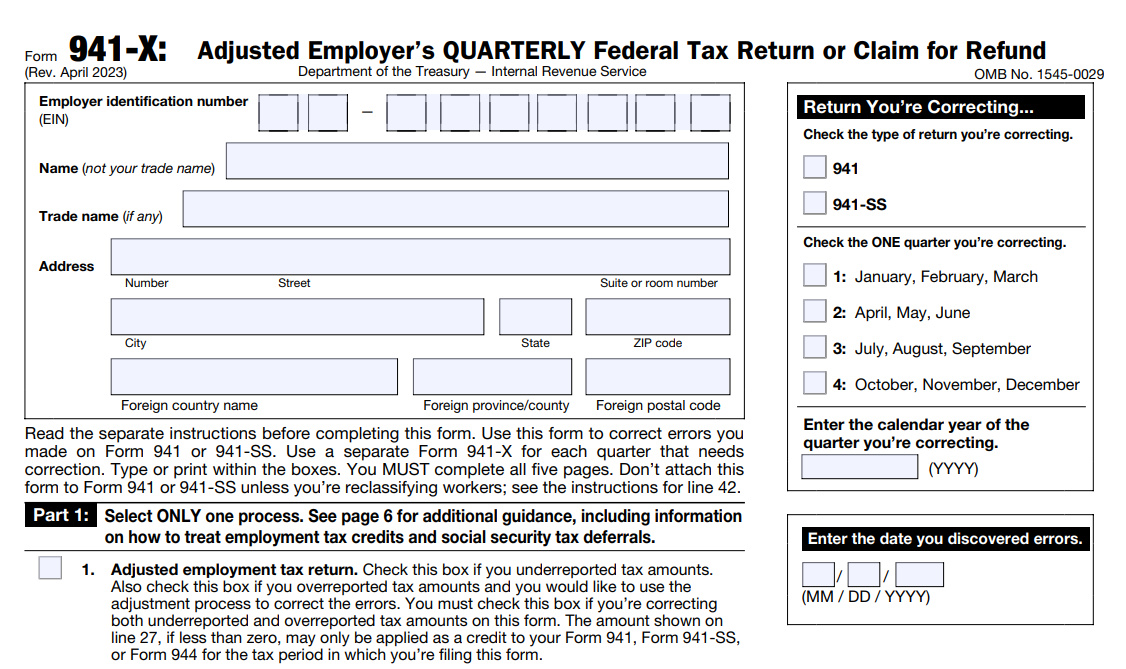

IRS Introduces New Changes to Form 941 for 2024 Tax1099 Blog

We will use the completed voucher to credit your payment more promptly and. Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. Form 941 is one of the most important forms that employers must file, which is also known as the employers quarterly federal tax return. It also.

Fillable Form 941 Employer'S Quarterly Federal Tax Return, Form 941V

It also provides space to. Understand who must file, payment methods, due dates, mailing. Learn filing essentials, get instructions, deadlines, mailing. Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. Tax year 2024 guide to the employer's quarterly federal tax form 941.

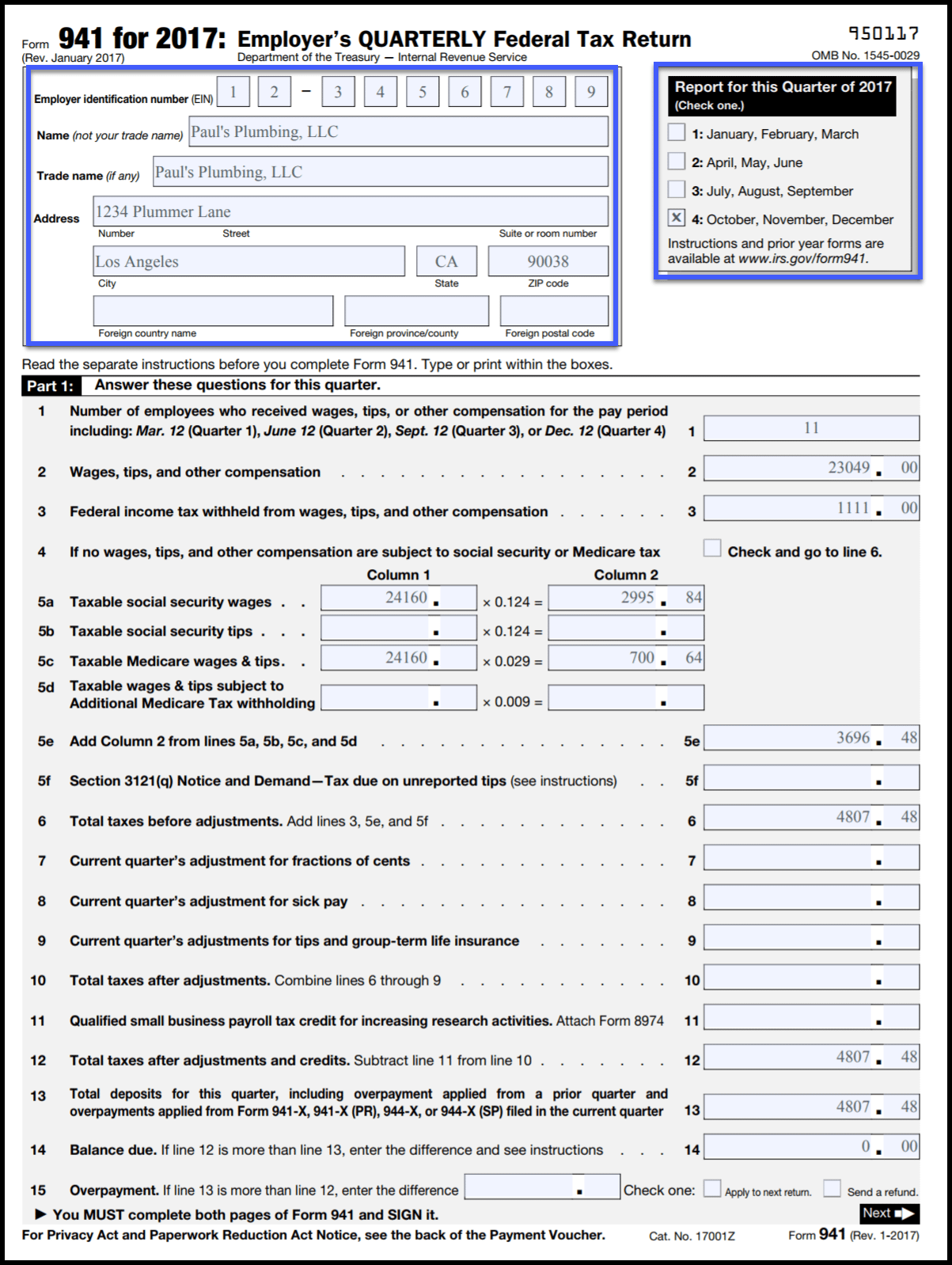

Form 941 Instructions & FICA Tax Rate 2018 (+ Mailing Address)

Learn filing essentials, get instructions, deadlines, mailing. Form 941 is one of the most important forms that employers must file, which is also known as the employers quarterly federal tax return. Learn everything about form 941—the employer’s quarterly federal tax return. It also provides space to. Tax year 2024 guide to the employer's quarterly federal tax form 941.

941 Forms TaxUni

Tax year 2024 guide to the employer's quarterly federal tax form 941. Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. We will use the completed voucher to credit your payment more promptly and. Learn filing essentials, get instructions, deadlines, mailing. Form 941 is one of the most.

File 941 Online How to EFile 941 Form for 2024

Understand who must file, payment methods, due dates, mailing. Form 941 is one of the most important forms that employers must file, which is also known as the employers quarterly federal tax return. Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. We will use the completed voucher.

Understand Who Must File, Payment Methods, Due Dates, Mailing.

Form 941 is one of the most important forms that employers must file, which is also known as the employers quarterly federal tax return. Irs form 941 is the form your business uses to report income taxes and payroll taxes withheld from your employee's wages. It also provides space to. We will use the completed voucher to credit your payment more promptly and.

Learn Everything About Form 941—The Employer’s Quarterly Federal Tax Return.

Learn filing essentials, get instructions, deadlines, mailing. Tax year 2024 guide to the employer's quarterly federal tax form 941.

:max_bytes(150000):strip_icc()/Screenshot41-609c5062555746a19a271903137d39a0.png)