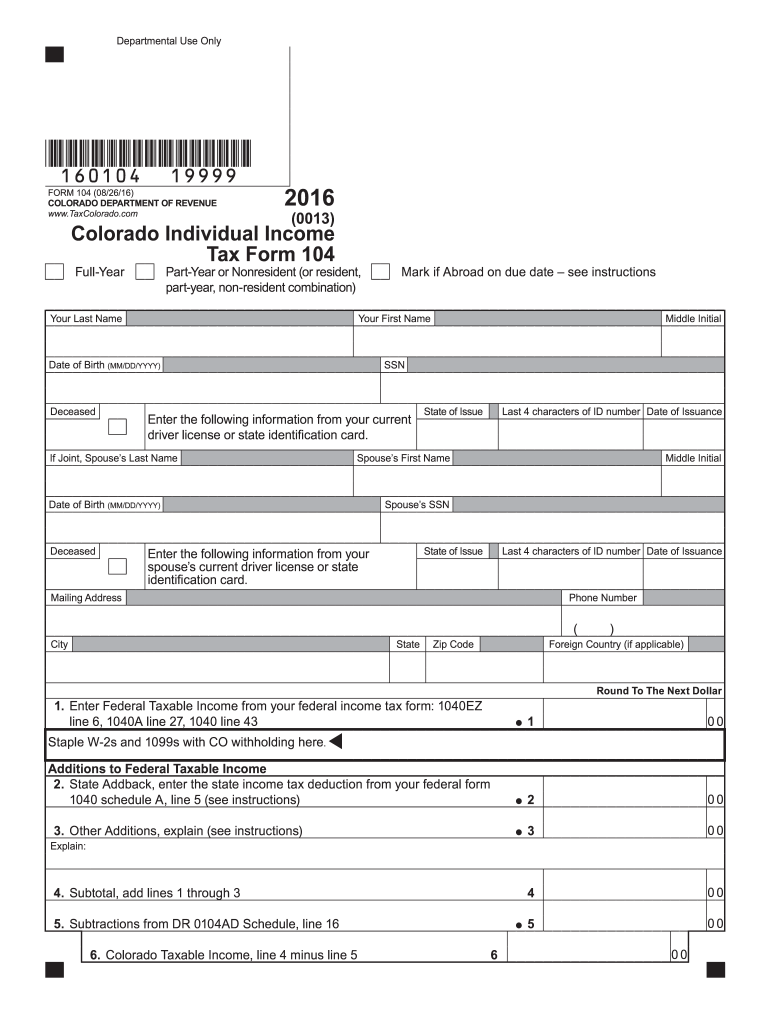

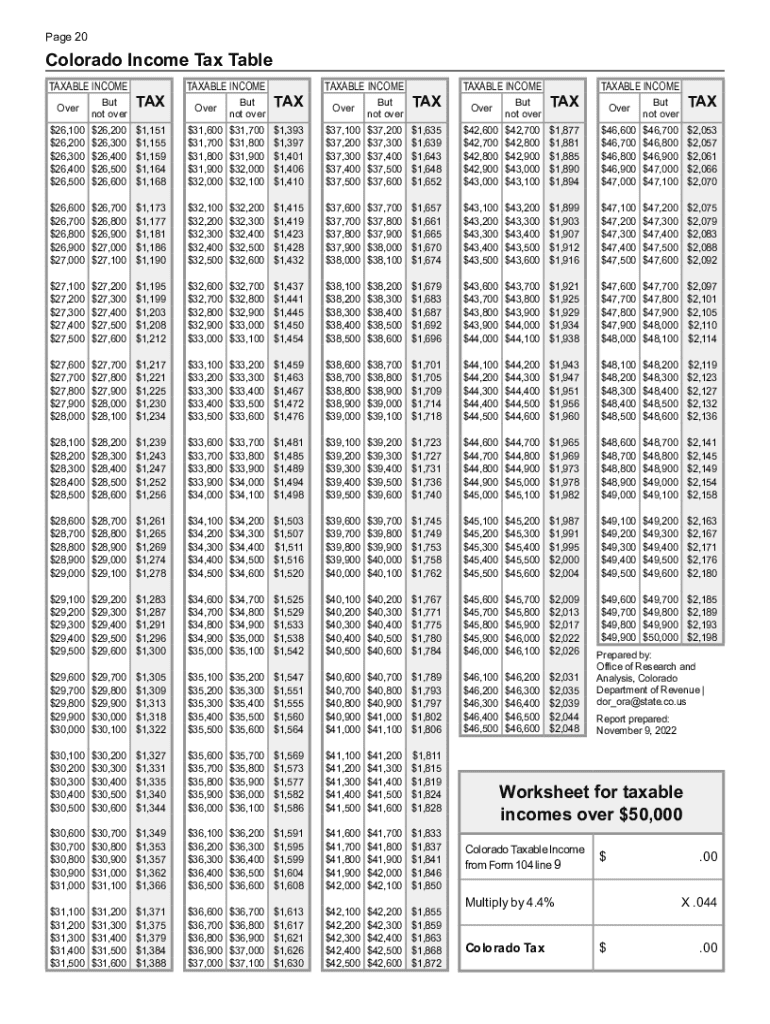

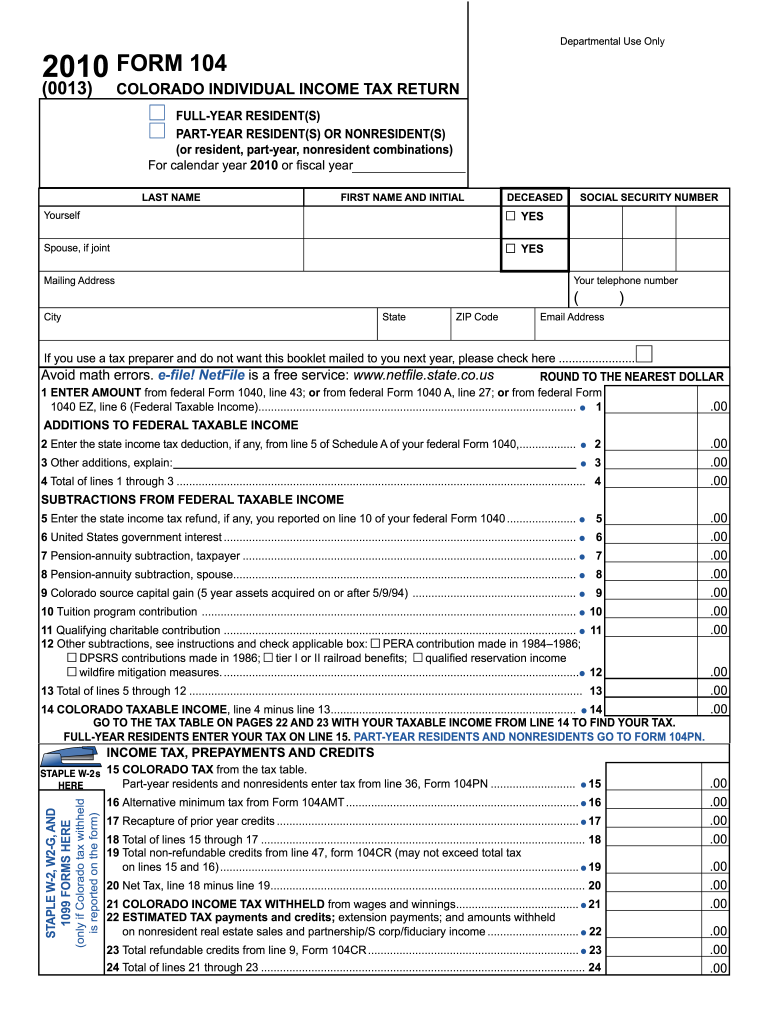

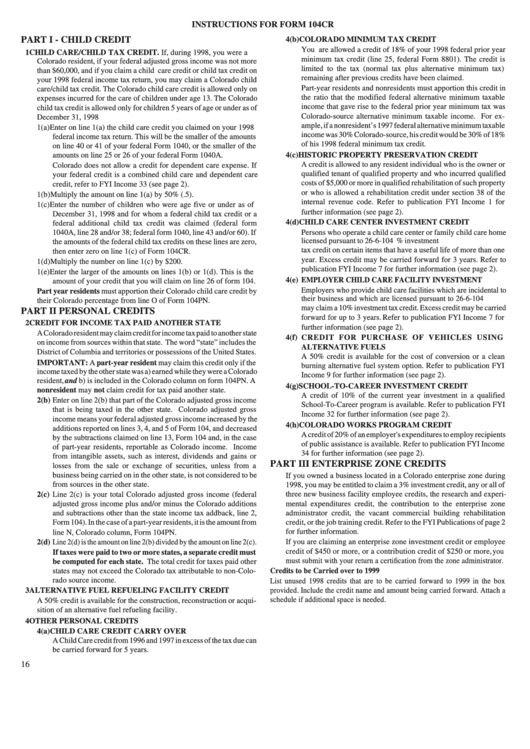

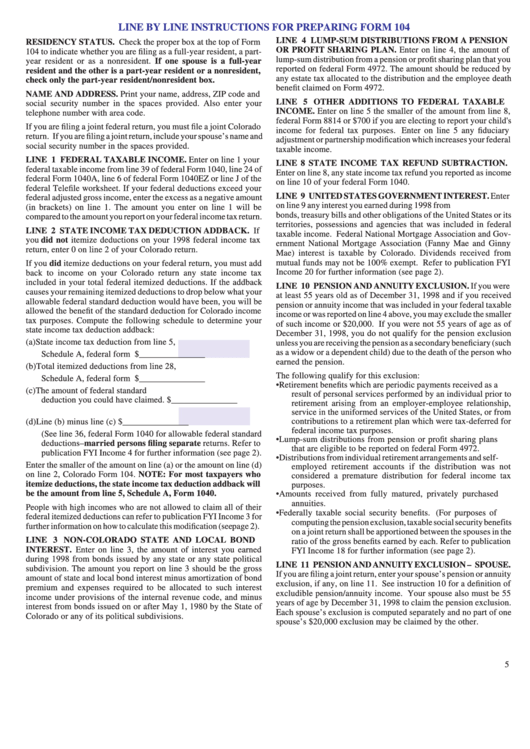

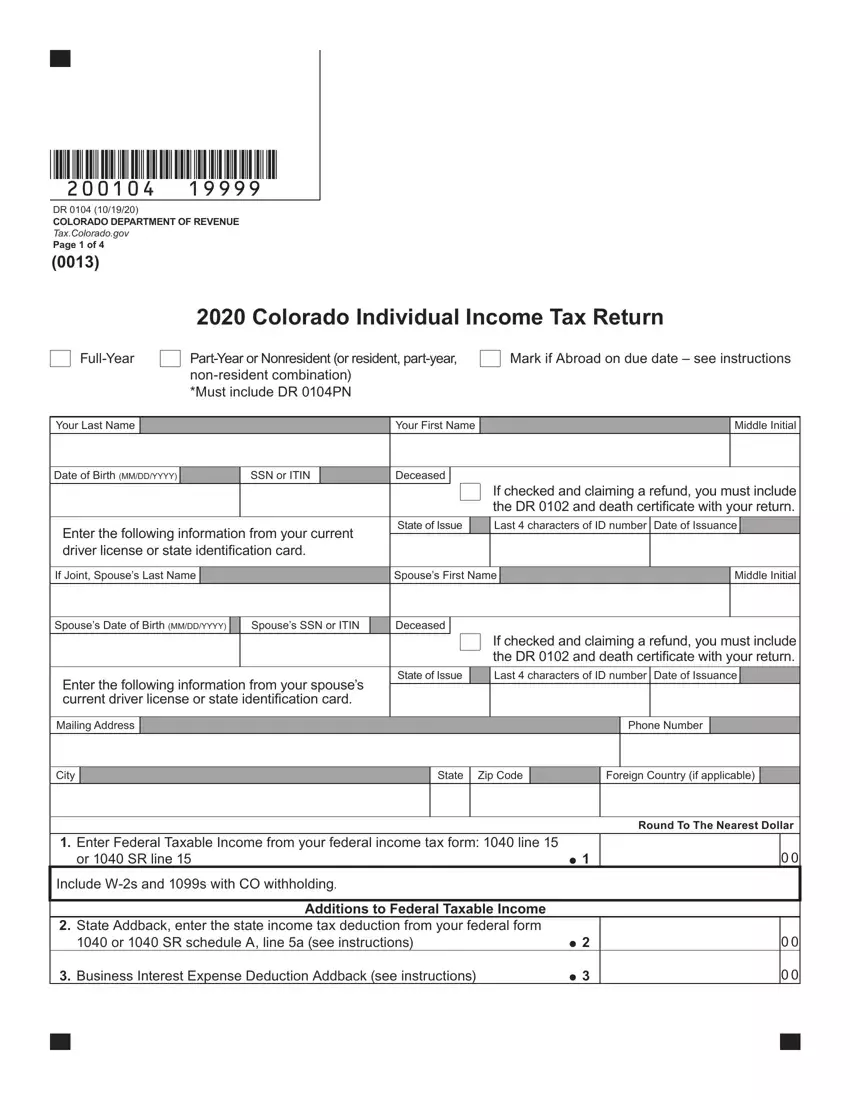

Co Form 104 Instructions - Colorado residents must file a colorado return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. To complete the third section, tax, prepayments and credits, you must carefully follow the instructions in the colorado individual income. ** employers and households both pay taxes to medicare and social security on employees’ behalf. Download or print the 2024 colorado form 104 (colorado income tax return) for free from the colorado department of revenue. Mts, lid, and lmd checks are cut directly. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return.

To complete the third section, tax, prepayments and credits, you must carefully follow the instructions in the colorado individual income. Colorado residents must file a colorado return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. ** employers and households both pay taxes to medicare and social security on employees’ behalf. Mts, lid, and lmd checks are cut directly. Download or print the 2024 colorado form 104 (colorado income tax return) for free from the colorado department of revenue. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return.

Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. To complete the third section, tax, prepayments and credits, you must carefully follow the instructions in the colorado individual income. Download or print the 2024 colorado form 104 (colorado income tax return) for free from the colorado department of revenue. Mts, lid, and lmd checks are cut directly. Colorado residents must file a colorado return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. ** employers and households both pay taxes to medicare and social security on employees’ behalf.

CO DoR 104 2016 Fill out Tax Template Online US Legal Forms

Mts, lid, and lmd checks are cut directly. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. Download or print the 2024 colorado form 104 (colorado income tax return) for free from the colorado department of revenue. To complete the third section, tax, prepayments and credits, you must carefully follow.

Colorado form 104 instructions Fill out & sign online DocHub

Colorado residents must file a colorado return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. ** employers and households both pay taxes to medicare and social security on employees’ behalf. Mts, lid, and lmd checks are cut directly. Use this instructional booklet to guide you.

Form 104 colorado Fill out & sign online DocHub

Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. To complete the third section, tax, prepayments and credits, you must carefully follow the instructions in the colorado individual income. ** employers and households both pay taxes to medicare and social security on employees’ behalf. Download or print the 2024 colorado.

Colorado Tax Form 104 Printable Printable Forms Free Online

** employers and households both pay taxes to medicare and social security on employees’ behalf. To complete the third section, tax, prepayments and credits, you must carefully follow the instructions in the colorado individual income. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. Download or print the 2024 colorado.

How To File Colorado Tax Taxes The Finance Gourmet

Download or print the 2024 colorado form 104 (colorado income tax return) for free from the colorado department of revenue. Mts, lid, and lmd checks are cut directly. Colorado residents must file a colorado return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. ** employers.

Top 5 Colorado Form 104 Templates free to download in PDF format

To complete the third section, tax, prepayments and credits, you must carefully follow the instructions in the colorado individual income. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. Colorado residents must file a colorado return if they are required to file an income tax return with the irs, even.

24 Colorado 104 Forms And Templates free to download in PDF

Mts, lid, and lmd checks are cut directly. Colorado residents must file a colorado return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. ** employers and.

Form 104X, Amended Colorado Individual Tax Return — PDFliner

To complete the third section, tax, prepayments and credits, you must carefully follow the instructions in the colorado individual income. Download or print the 2024 colorado form 104 (colorado income tax return) for free from the colorado department of revenue. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. Colorado.

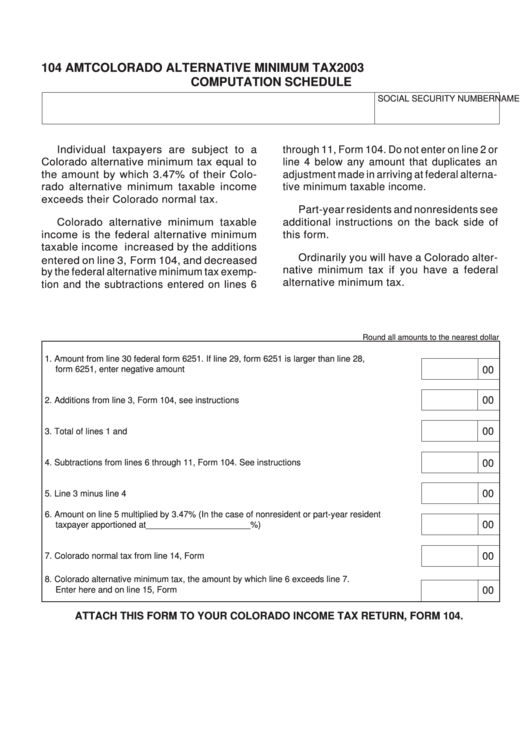

Form 104 Amt Colorado Alternative Minimum Tax Computation Schedule

Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. Mts, lid, and lmd checks are cut directly. ** employers and households both pay taxes to medicare and social security on employees’ behalf. To complete the third section, tax, prepayments and credits, you must carefully follow the instructions in the colorado.

Colorado Form 104 ≡ Fill Out Printable PDF Forms Online

Mts, lid, and lmd checks are cut directly. Download or print the 2024 colorado form 104 (colorado income tax return) for free from the colorado department of revenue. ** employers and households both pay taxes to medicare and social security on employees’ behalf. To complete the third section, tax, prepayments and credits, you must carefully follow the instructions in the.

To Complete The Third Section, Tax, Prepayments And Credits, You Must Carefully Follow The Instructions In The Colorado Individual Income.

Colorado residents must file a colorado return if they are required to file an income tax return with the irs, even if they do not have a colorado tax liability. ** employers and households both pay taxes to medicare and social security on employees’ behalf. Use this instructional booklet to guide you in filling out and filing your form 104 individual income tax return. Download or print the 2024 colorado form 104 (colorado income tax return) for free from the colorado department of revenue.