Company Tax Return Form - Gather bank statements, bookkeeping records and your ct600 form for a smooth filing process! Get a list of irs forms for corporations.page last reviewed or updated: Essential irs tax forms and deadlines every small business owner should know see which common business tax forms apply to. File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. Ready to file your company tax return? You can report all of your business income and business expenses on schedule c, which you file with your personal income tax.

Get a list of irs forms for corporations.page last reviewed or updated: Ready to file your company tax return? File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. Essential irs tax forms and deadlines every small business owner should know see which common business tax forms apply to. Gather bank statements, bookkeeping records and your ct600 form for a smooth filing process! You can report all of your business income and business expenses on schedule c, which you file with your personal income tax.

File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. Essential irs tax forms and deadlines every small business owner should know see which common business tax forms apply to. Get a list of irs forms for corporations.page last reviewed or updated: You can report all of your business income and business expenses on schedule c, which you file with your personal income tax. Ready to file your company tax return? Gather bank statements, bookkeeping records and your ct600 form for a smooth filing process!

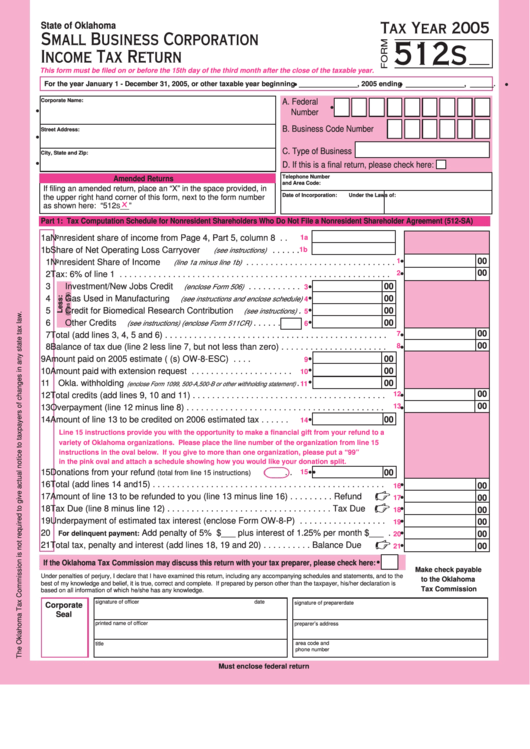

Tax Form For S Corp at Philip Mayers blog

Get a list of irs forms for corporations.page last reviewed or updated: Gather bank statements, bookkeeping records and your ct600 form for a smooth filing process! You can report all of your business income and business expenses on schedule c, which you file with your personal income tax. Essential irs tax forms and deadlines every small business owner should know.

Fillable Form 512s Small Business Corporation Tax Return

You can report all of your business income and business expenses on schedule c, which you file with your personal income tax. Ready to file your company tax return? File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. Gather bank statements, bookkeeping records and your ct600 form for a.

UK Company Short Tax Return Form CT600 PDF United Kingdom

File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. Ready to file your company tax return? Gather bank statements, bookkeeping records and your ct600 form for a smooth filing process! Essential irs tax forms and deadlines every small business owner should know see which common business tax forms apply.

What Is IRS Form 1120 Tax Return Form For Corporation

Essential irs tax forms and deadlines every small business owner should know see which common business tax forms apply to. Get a list of irs forms for corporations.page last reviewed or updated: Ready to file your company tax return? File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. You.

2020 Form Canada T2 Corporation Tax Return Fill Online

Gather bank statements, bookkeeping records and your ct600 form for a smooth filing process! File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. You can report all of your business income and business expenses on schedule c, which you file with your personal income tax. Essential irs tax forms.

Ct600 form Fill out & sign online DocHub

Gather bank statements, bookkeeping records and your ct600 form for a smooth filing process! Get a list of irs forms for corporations.page last reviewed or updated: File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. Ready to file your company tax return? Essential irs tax forms and deadlines every.

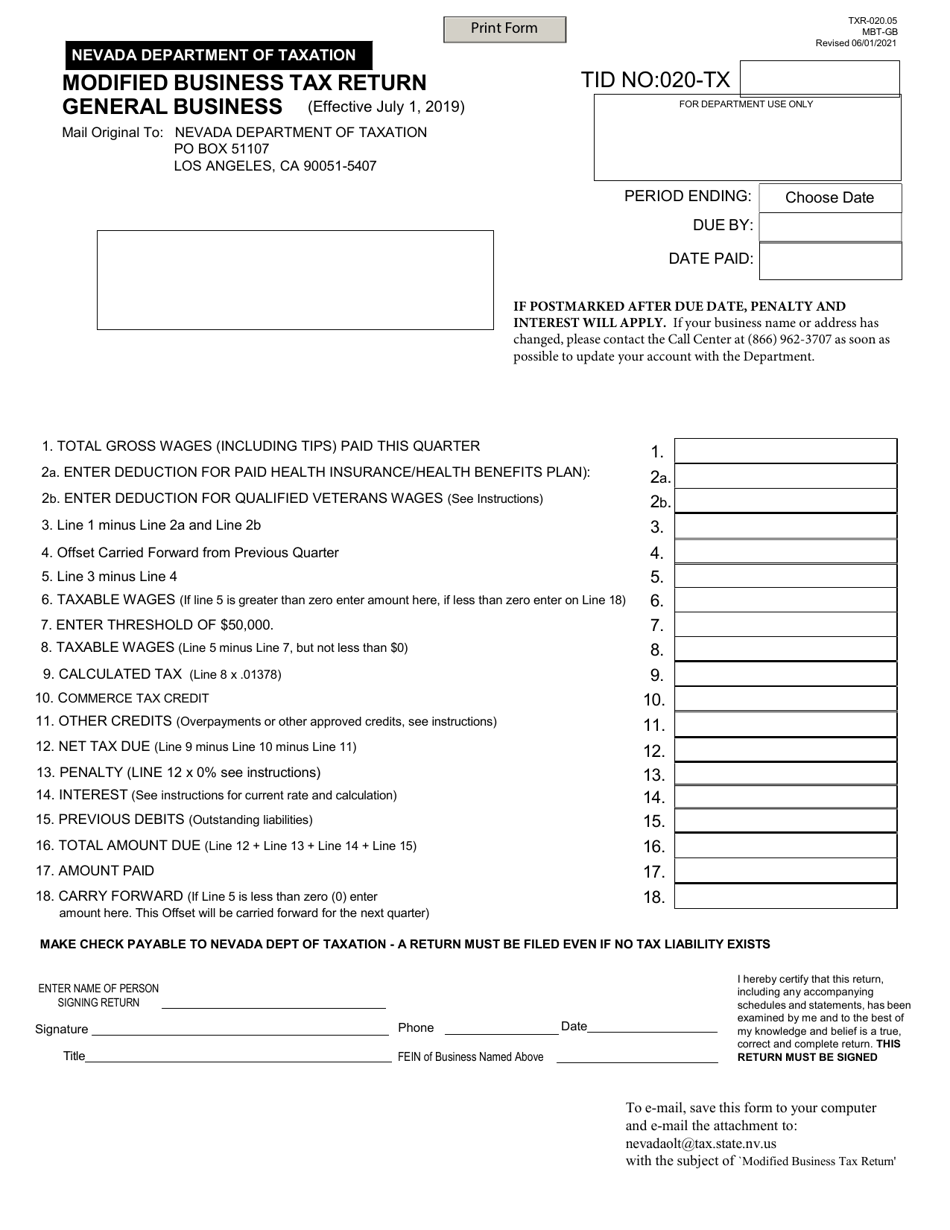

Form TXR020.05 Download Fillable PDF or Fill Online Modified Business

File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. Gather bank statements, bookkeeping records and your ct600 form for a smooth filing process! Ready to file your company tax return? You can report all of your business income and business expenses on schedule c, which you file with your.

Publication Details

Essential irs tax forms and deadlines every small business owner should know see which common business tax forms apply to. You can report all of your business income and business expenses on schedule c, which you file with your personal income tax. Gather bank statements, bookkeeping records and your ct600 form for a smooth filing process! Get a list of.

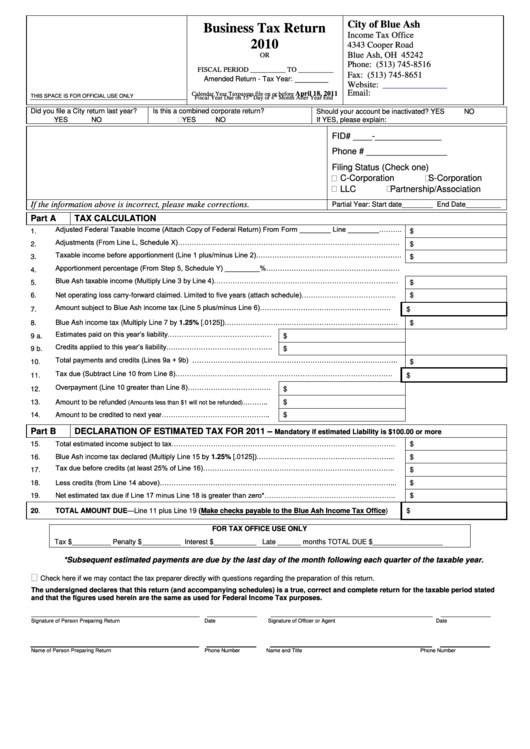

Business Tax Return Form City Of Blue Ash 2010 printable pdf download

Gather bank statements, bookkeeping records and your ct600 form for a smooth filing process! Essential irs tax forms and deadlines every small business owner should know see which common business tax forms apply to. Get a list of irs forms for corporations.page last reviewed or updated: You can report all of your business income and business expenses on schedule c,.

Changes affecting the CT600 Company Tax Return form United Kingdom

Get a list of irs forms for corporations.page last reviewed or updated: Ready to file your company tax return? File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. You can report all of your business income and business expenses on schedule c, which you file with your personal income.

Gather Bank Statements, Bookkeeping Records And Your Ct600 Form For A Smooth Filing Process!

You can report all of your business income and business expenses on schedule c, which you file with your personal income tax. File your s corporation or c corporation income tax returns successfully by following these steps for corporate tax return filing. Get a list of irs forms for corporations.page last reviewed or updated: Ready to file your company tax return?

:max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png)