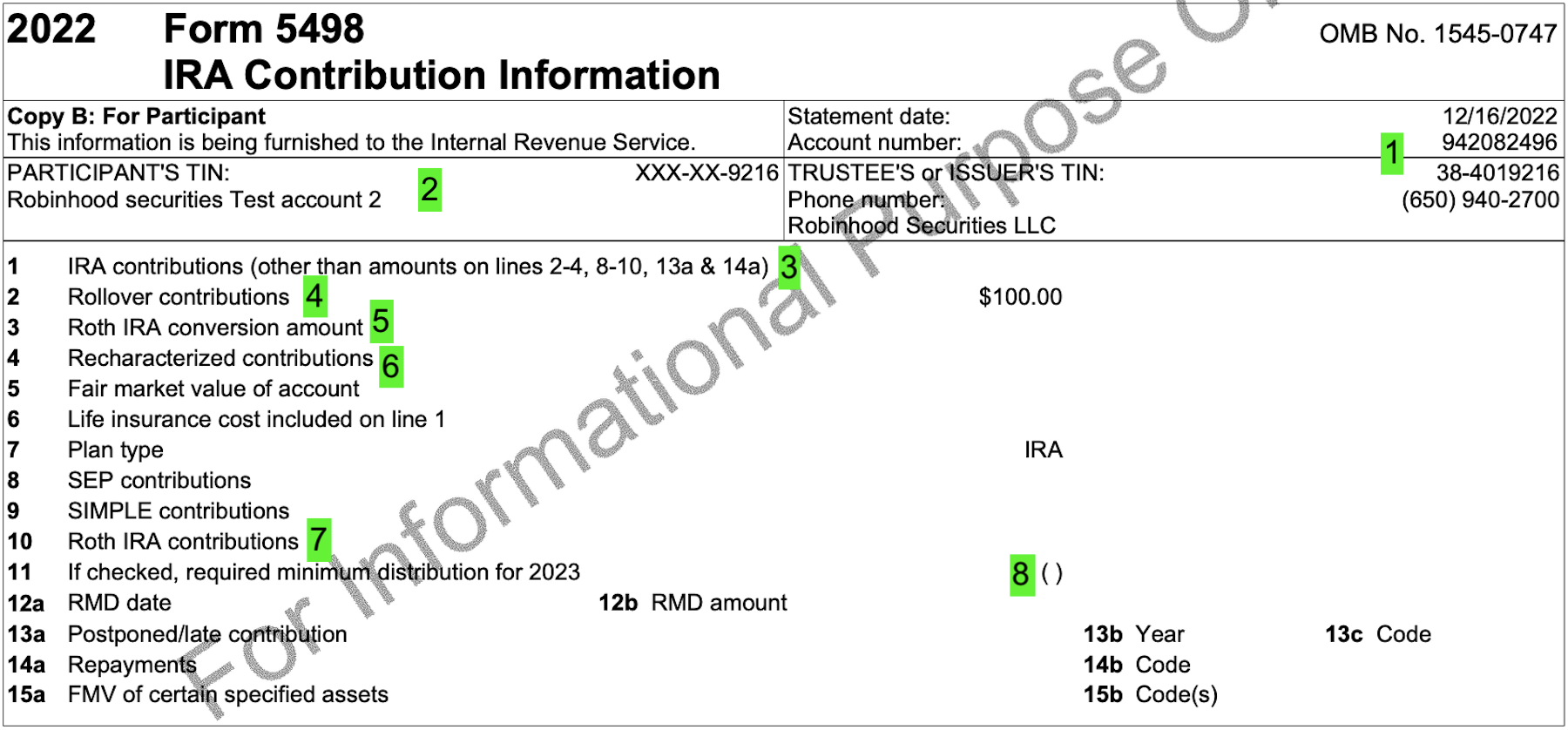

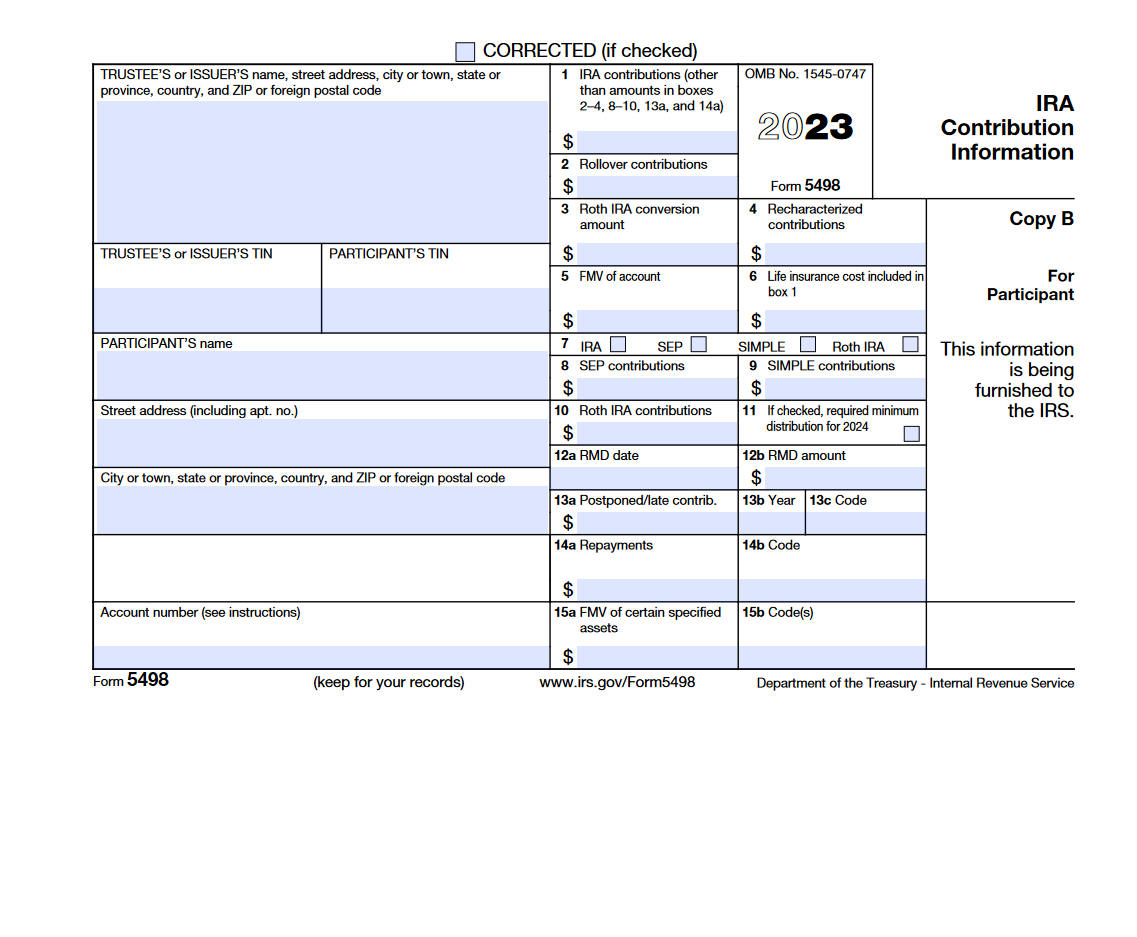

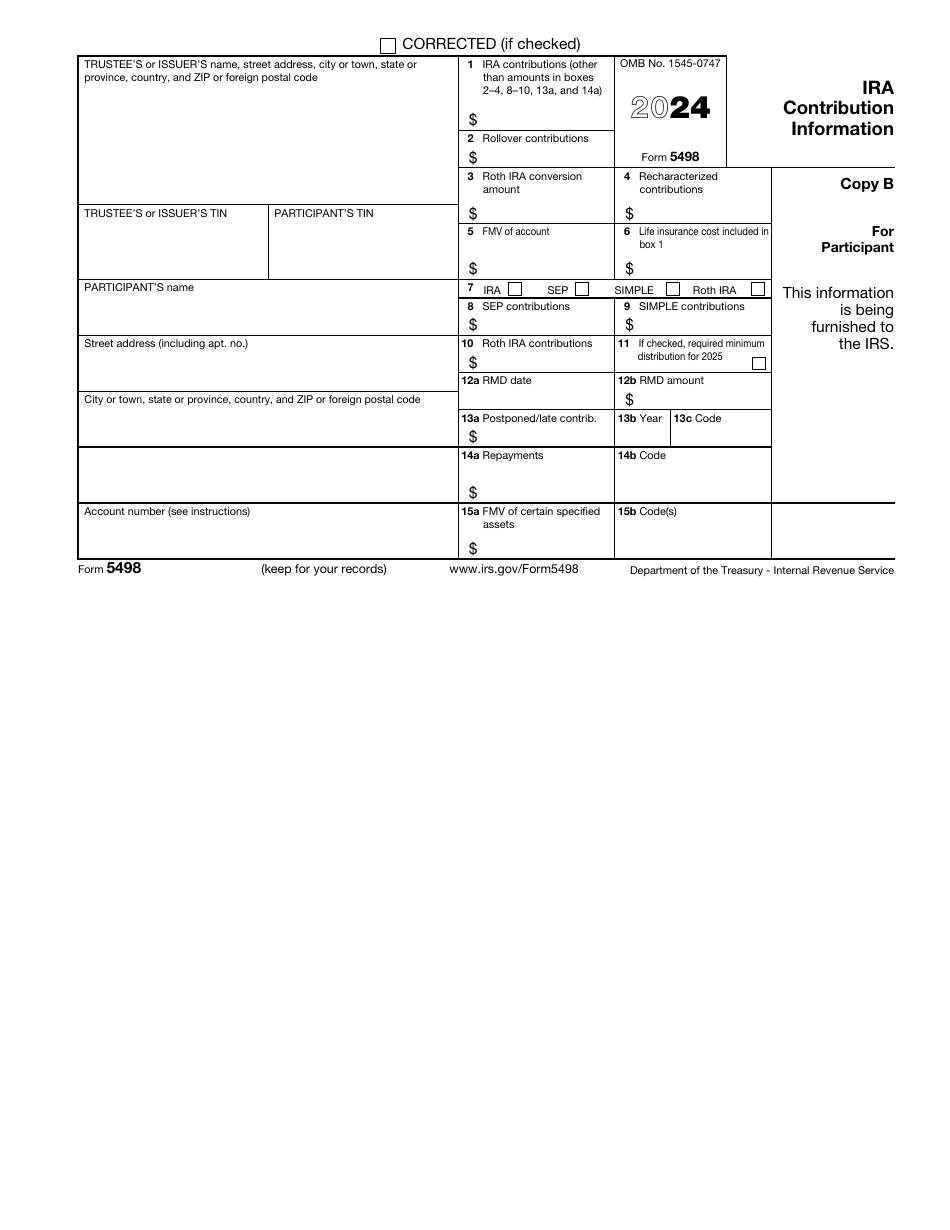

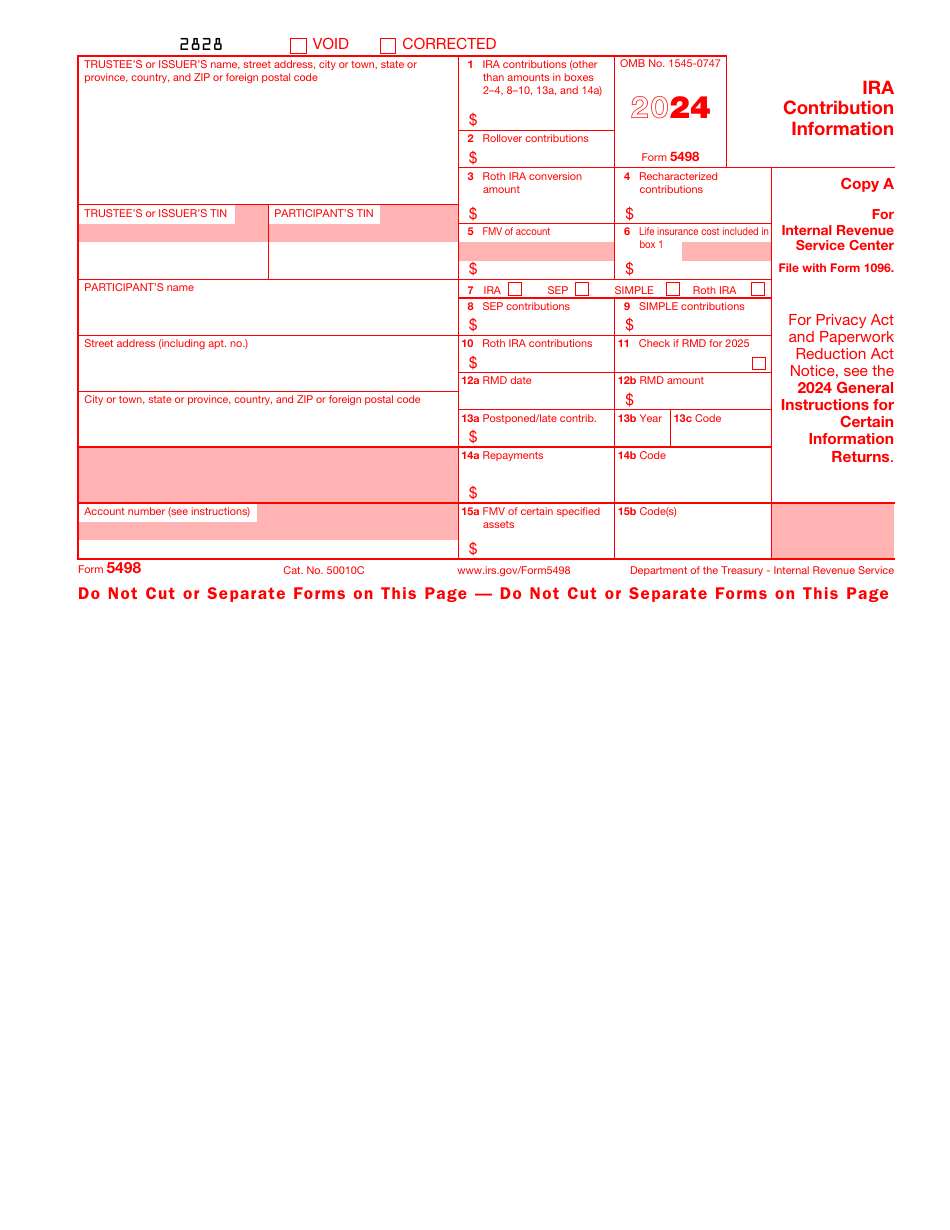

Form 5498 - Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to. Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Form 5498 can help you keep track of contributions you've made to a traditional ira, roth ira, sep ira, or simple ira. Issued by financial institutions, it. Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required. Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs.

Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required. Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to. Form 5498 can help you keep track of contributions you've made to a traditional ira, roth ira, sep ira, or simple ira. Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs. Issued by financial institutions, it.

Issued by financial institutions, it. Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to. Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required. Form 5498 can help you keep track of contributions you've made to a traditional ira, roth ira, sep ira, or simple ira. Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs.

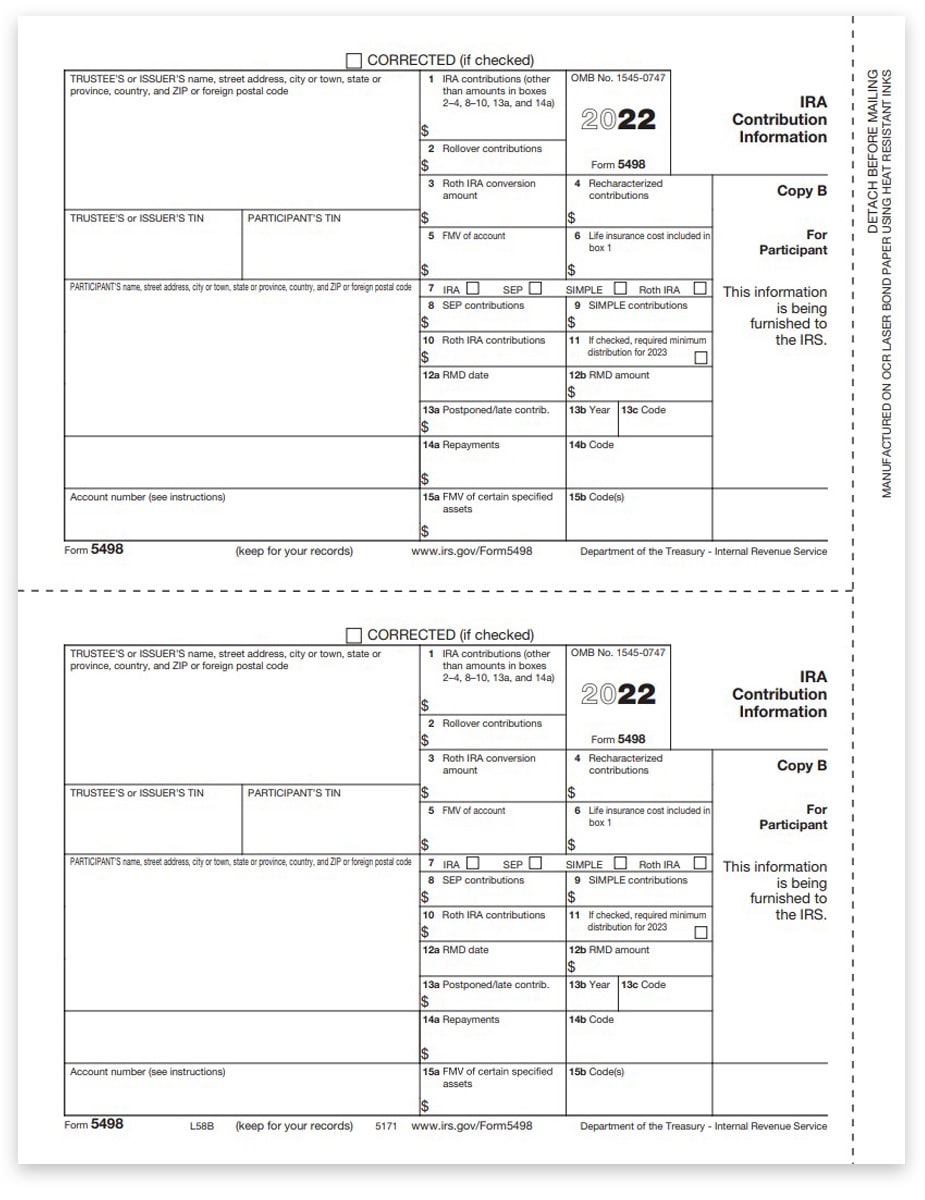

5498 Forms for IRA Contributions, Participant Copy B DiscountTaxForms

Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs. Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required. Form 5498 can help you keep track of contributions you've made to a traditional ira, roth ira, sep ira, or simple ira..

Agriculture Machinery, Equipment, Technology in India Shop It

Form 5498 can help you keep track of contributions you've made to a traditional ira, roth ira, sep ira, or simple ira. Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required. Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Your ira custodian reports contributions that you.

IRS Form 5498 BoxbyBox — Ascensus

Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to. Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs. Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required. Form 5498.

IRS Form 5498 Instructions

Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to. Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Issued by financial institutions, it. Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs..

The Purpose of IRS Form 5498

Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs. Issued by financial institutions, it. Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required. Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Form 5498 can.

Robinhood 1099 Form 2023 Printable Forms Free Online

Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required. Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs. Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Form 5498 can help you keep track of.

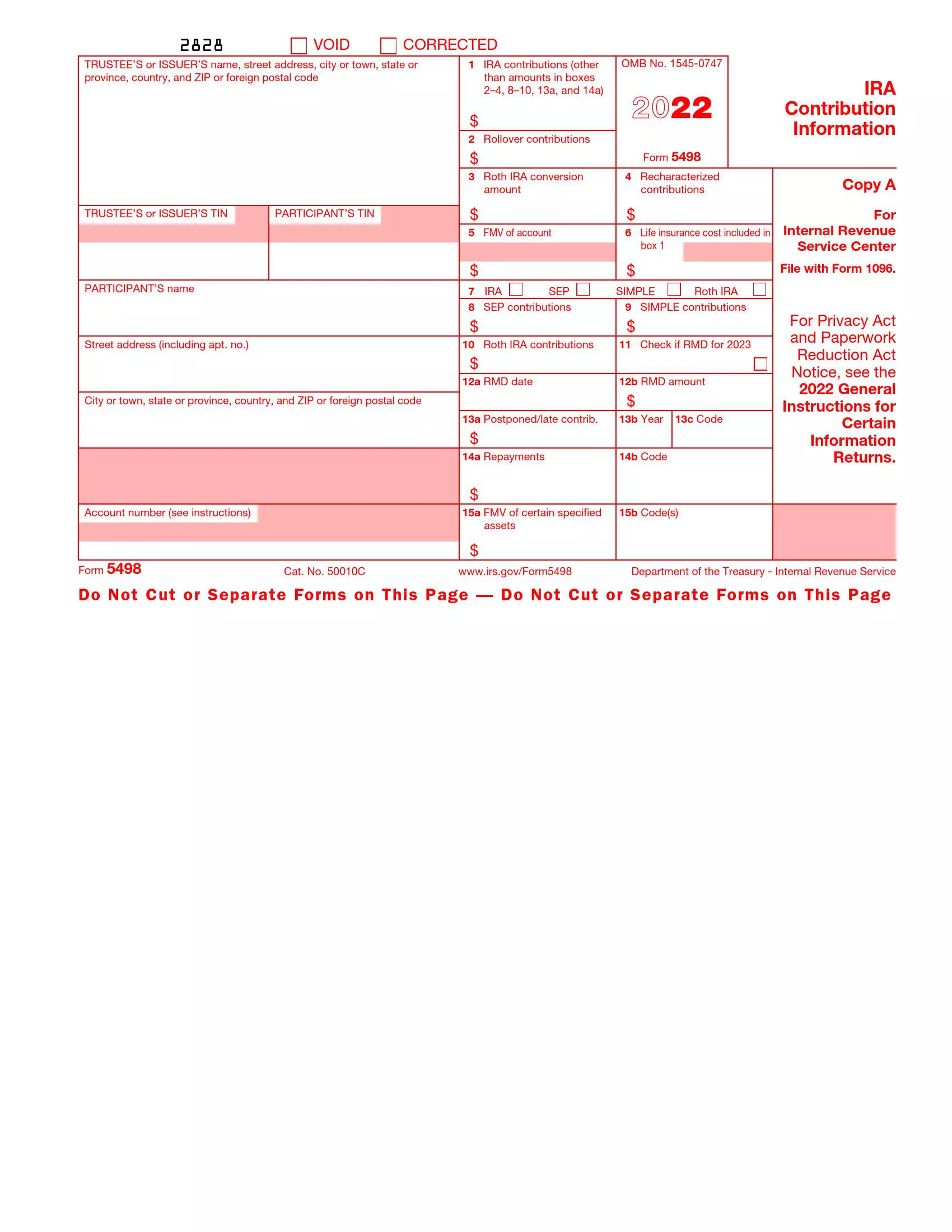

IRS Form 5498. IRA Contribution Information Forms Docs 2023

Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs. Issued by financial institutions, it. Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required. Form 5498 can.

Everything You Need To Know About Tax Form 5498

Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to. Form 5498 can help you keep track of contributions you've made to a traditional ira, roth ira, sep ira, or simple ira. Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Your ira custodian reports.

IRS Form 5498 Download Printable PDF or Fill Online Ira Contribution

Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to. Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs. Form 5498 can help you.

IRS Form 5498 Download Printable PDF or Fill Online Ira Contribution

Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to. Form 5498 records contributions made to individual retirement accounts (iras) during the tax year. Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required. Your ira custodian reports contributions that you make on.

Issued By Financial Institutions, It.

Your ira custodian reports contributions that you make on form 5498 and provides the form to both you and the irs. Form 5498 can help you keep track of contributions you've made to a traditional ira, roth ira, sep ira, or simple ira. Information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to. Ira account holders receive form 5498 which includes information about their contributions, rollovers, roth conversions, and required.

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png)