Irs Form 4255 - Use form 4255 to figure the increase in the amount due for certain credit recaptures, excessive payments, and penalties. When you claim an investment credit but you're no longer eligible for it, you may. Information about form 4255, recapture of investment credit, including recent updates, related forms and instructions on how to. Although the statutory and regulatory rules did not specifically address how taxpayers are to make such penalty payments, the irs has now. Form 4255 is used for investment credit recapture. The irs has released form 4255 for the tax year 2024, which is used for the reporting and payment of recapture of investment credit,.

When you claim an investment credit but you're no longer eligible for it, you may. Use form 4255 to figure the increase in the amount due for certain credit recaptures, excessive payments, and penalties. Information about form 4255, recapture of investment credit, including recent updates, related forms and instructions on how to. Although the statutory and regulatory rules did not specifically address how taxpayers are to make such penalty payments, the irs has now. The irs has released form 4255 for the tax year 2024, which is used for the reporting and payment of recapture of investment credit,. Form 4255 is used for investment credit recapture.

The irs has released form 4255 for the tax year 2024, which is used for the reporting and payment of recapture of investment credit,. When you claim an investment credit but you're no longer eligible for it, you may. Form 4255 is used for investment credit recapture. Information about form 4255, recapture of investment credit, including recent updates, related forms and instructions on how to. Use form 4255 to figure the increase in the amount due for certain credit recaptures, excessive payments, and penalties. Although the statutory and regulatory rules did not specifically address how taxpayers are to make such penalty payments, the irs has now.

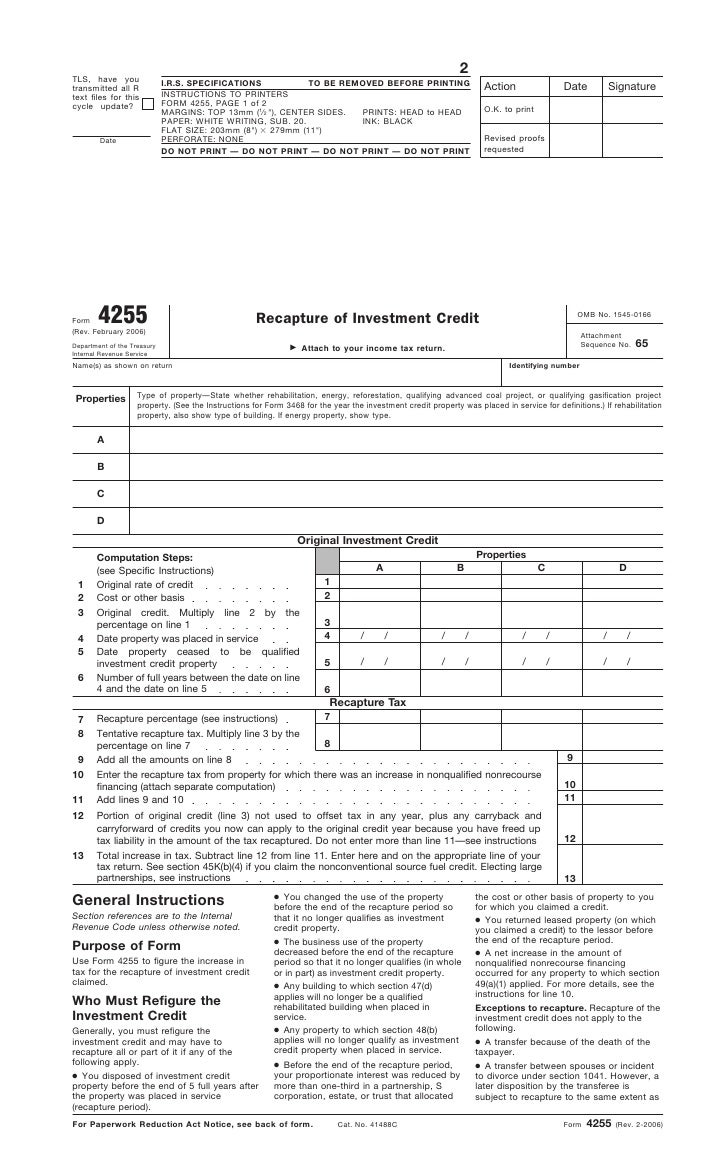

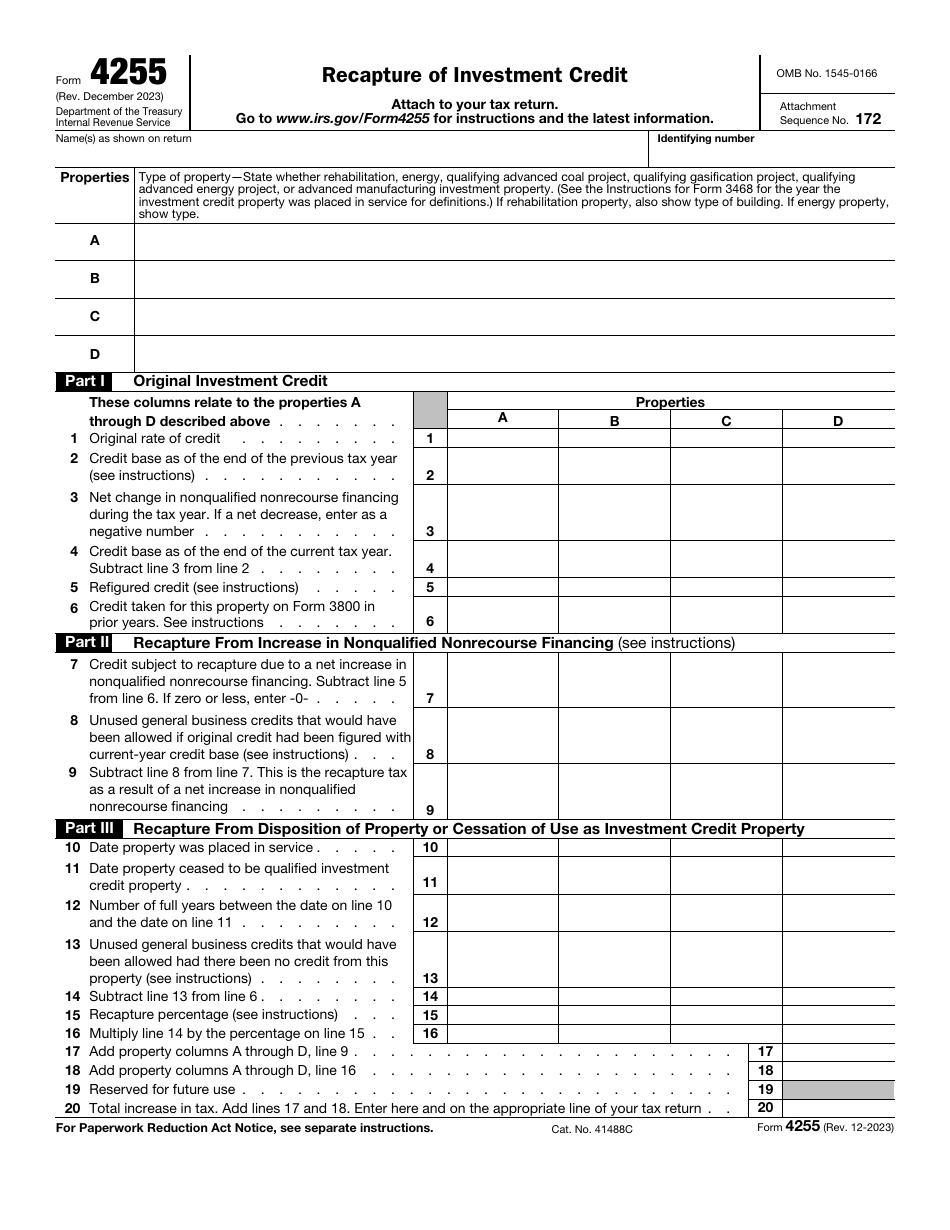

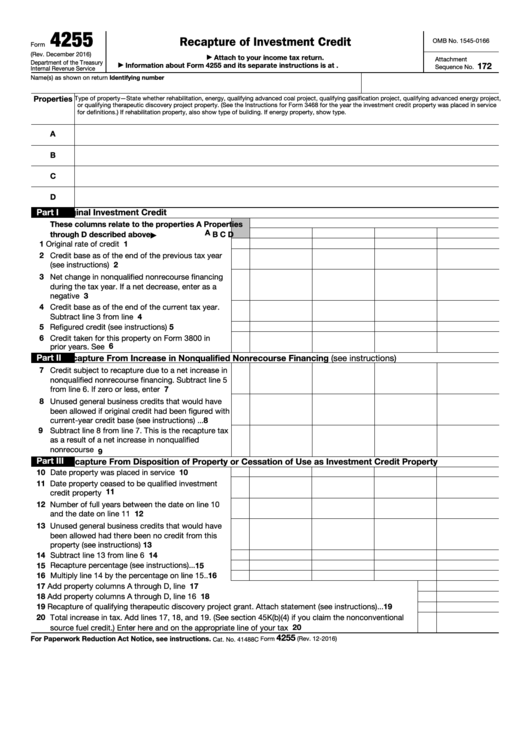

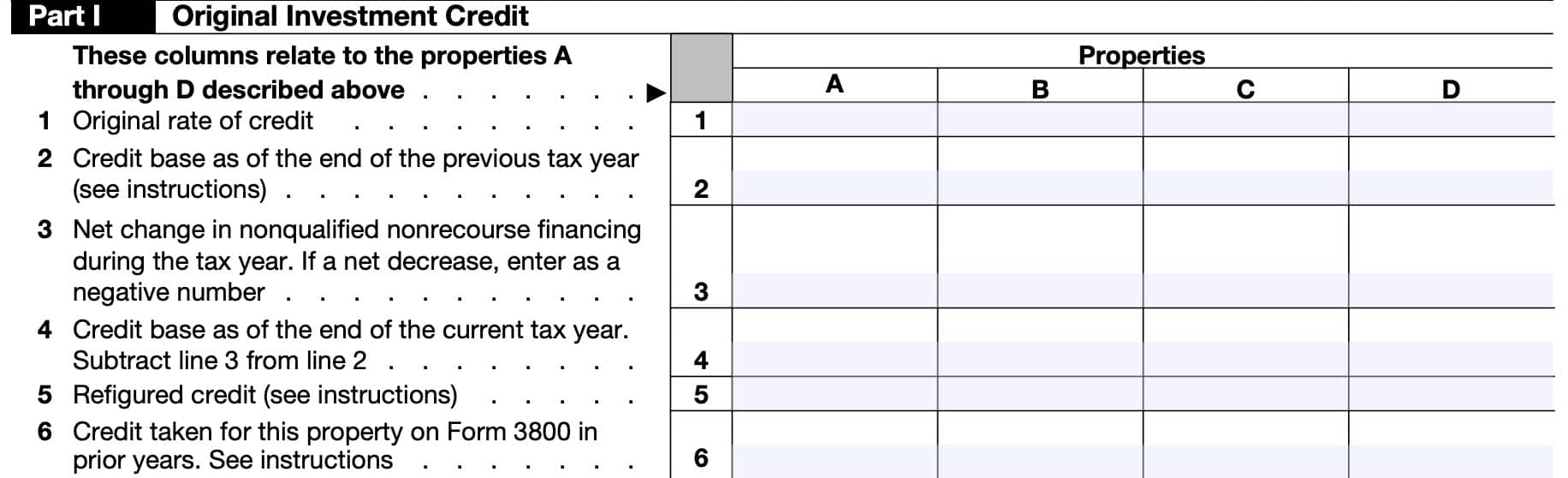

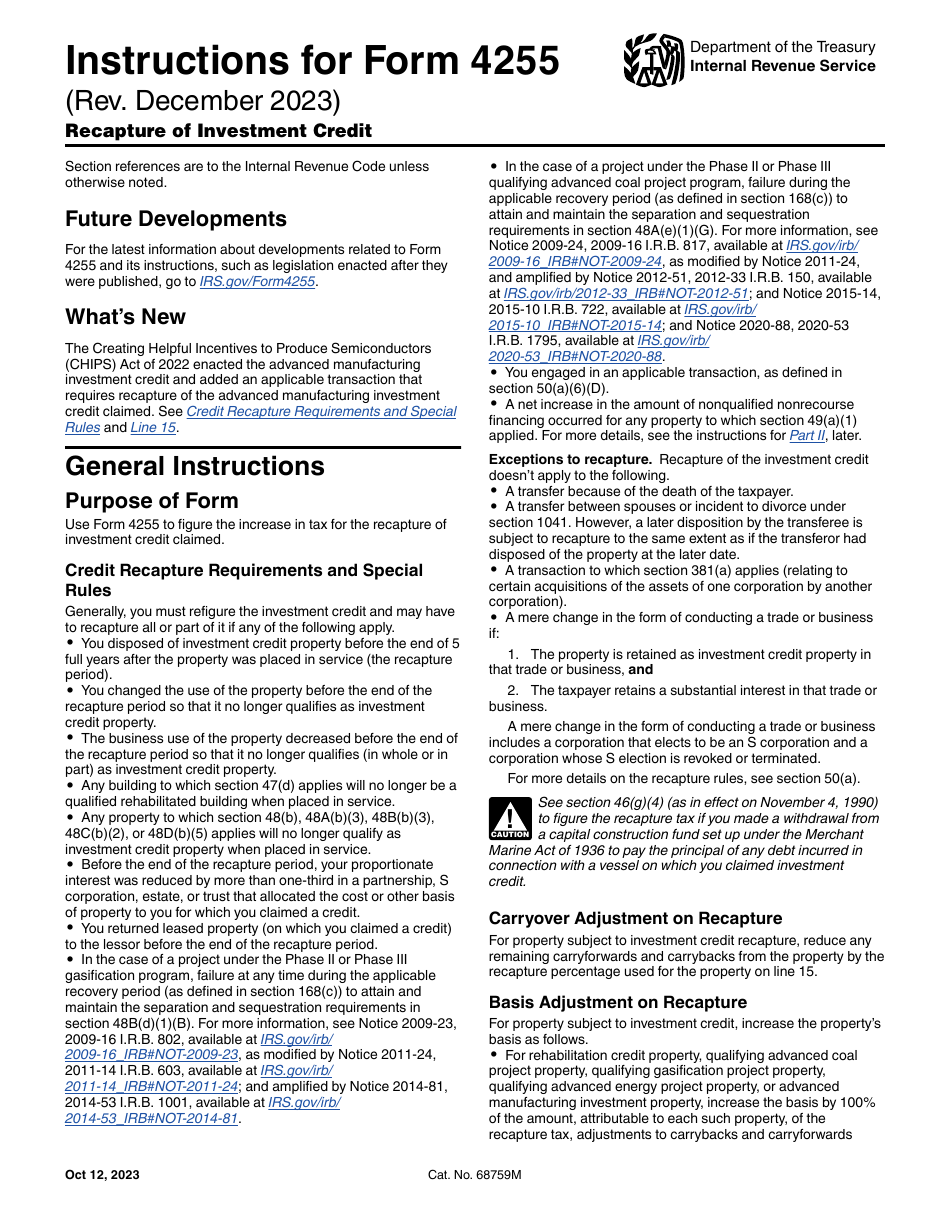

IRS Form 4255 Instructions Recapture of Investment Credit

Although the statutory and regulatory rules did not specifically address how taxpayers are to make such penalty payments, the irs has now. Form 4255 is used for investment credit recapture. When you claim an investment credit but you're no longer eligible for it, you may. Information about form 4255, recapture of investment credit, including recent updates, related forms and instructions.

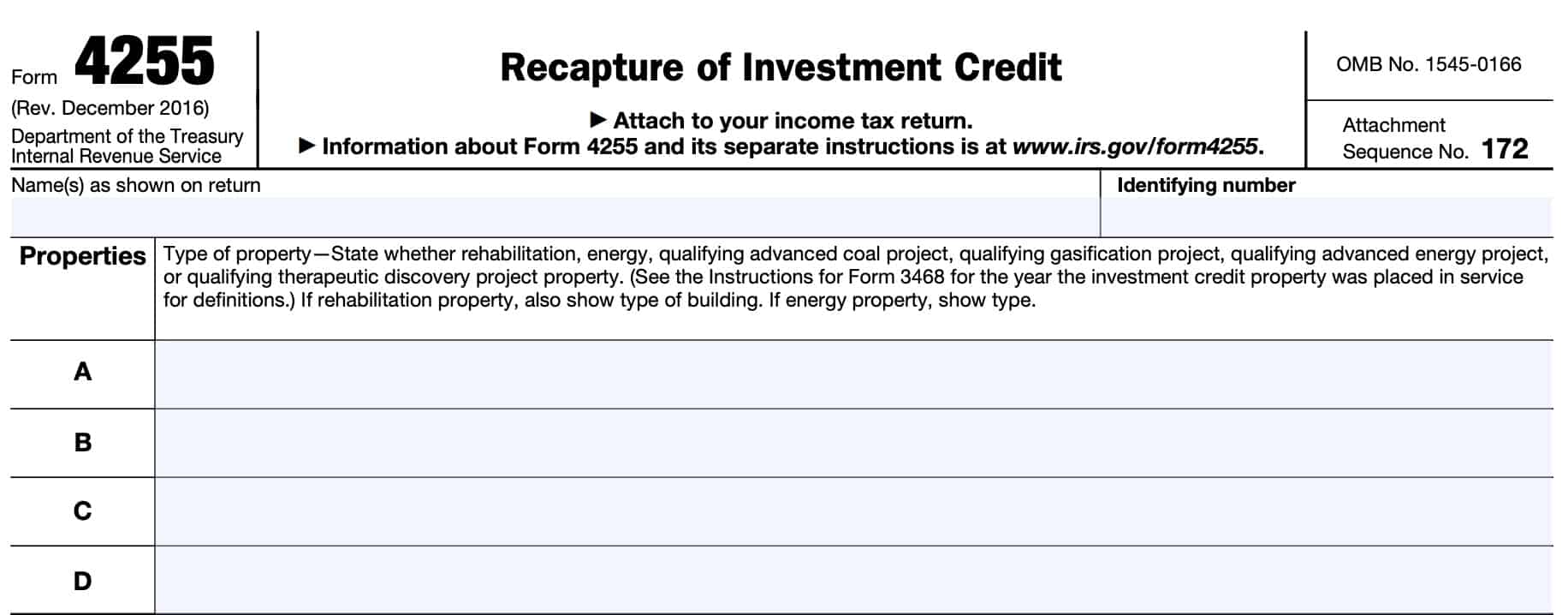

Form 4255*Recapture of Investment Credit

The irs has released form 4255 for the tax year 2024, which is used for the reporting and payment of recapture of investment credit,. When you claim an investment credit but you're no longer eligible for it, you may. Use form 4255 to figure the increase in the amount due for certain credit recaptures, excessive payments, and penalties. Form 4255.

IRS Form 4255 Download Fillable PDF or Fill Online Recapture of

When you claim an investment credit but you're no longer eligible for it, you may. Information about form 4255, recapture of investment credit, including recent updates, related forms and instructions on how to. Although the statutory and regulatory rules did not specifically address how taxpayers are to make such penalty payments, the irs has now. Form 4255 is used for.

Download Instructions for IRS Form 4255 Recapture of Investment Credit

Information about form 4255, recapture of investment credit, including recent updates, related forms and instructions on how to. The irs has released form 4255 for the tax year 2024, which is used for the reporting and payment of recapture of investment credit,. When you claim an investment credit but you're no longer eligible for it, you may. Use form 4255.

Fillable Form 4255 Recapture Of Investment Credit printable pdf download

The irs has released form 4255 for the tax year 2024, which is used for the reporting and payment of recapture of investment credit,. Form 4255 is used for investment credit recapture. Use form 4255 to figure the increase in the amount due for certain credit recaptures, excessive payments, and penalties. Although the statutory and regulatory rules did not specifically.

IRS Form 4255 Instructions Recapture of Investment Credit

When you claim an investment credit but you're no longer eligible for it, you may. Although the statutory and regulatory rules did not specifically address how taxpayers are to make such penalty payments, the irs has now. Information about form 4255, recapture of investment credit, including recent updates, related forms and instructions on how to. The irs has released form.

IRS Form 4255 Instructions Recapture of Investment Credit

Information about form 4255, recapture of investment credit, including recent updates, related forms and instructions on how to. Although the statutory and regulatory rules did not specifically address how taxpayers are to make such penalty payments, the irs has now. Use form 4255 to figure the increase in the amount due for certain credit recaptures, excessive payments, and penalties. The.

IRS Form 4255 Instructions Recapture of Investment Credit

Use form 4255 to figure the increase in the amount due for certain credit recaptures, excessive payments, and penalties. When you claim an investment credit but you're no longer eligible for it, you may. Although the statutory and regulatory rules did not specifically address how taxpayers are to make such penalty payments, the irs has now. The irs has released.

Form 4255 Recapture of Investment Credit (2013) Free Download

The irs has released form 4255 for the tax year 2024, which is used for the reporting and payment of recapture of investment credit,. When you claim an investment credit but you're no longer eligible for it, you may. Form 4255 is used for investment credit recapture. Use form 4255 to figure the increase in the amount due for certain.

Download Instructions for IRS Form 4255 Recapture of Investment Credit

The irs has released form 4255 for the tax year 2024, which is used for the reporting and payment of recapture of investment credit,. Although the statutory and regulatory rules did not specifically address how taxpayers are to make such penalty payments, the irs has now. Use form 4255 to figure the increase in the amount due for certain credit.

The Irs Has Released Form 4255 For The Tax Year 2024, Which Is Used For The Reporting And Payment Of Recapture Of Investment Credit,.

When you claim an investment credit but you're no longer eligible for it, you may. Form 4255 is used for investment credit recapture. Information about form 4255, recapture of investment credit, including recent updates, related forms and instructions on how to. Use form 4255 to figure the increase in the amount due for certain credit recaptures, excessive payments, and penalties.