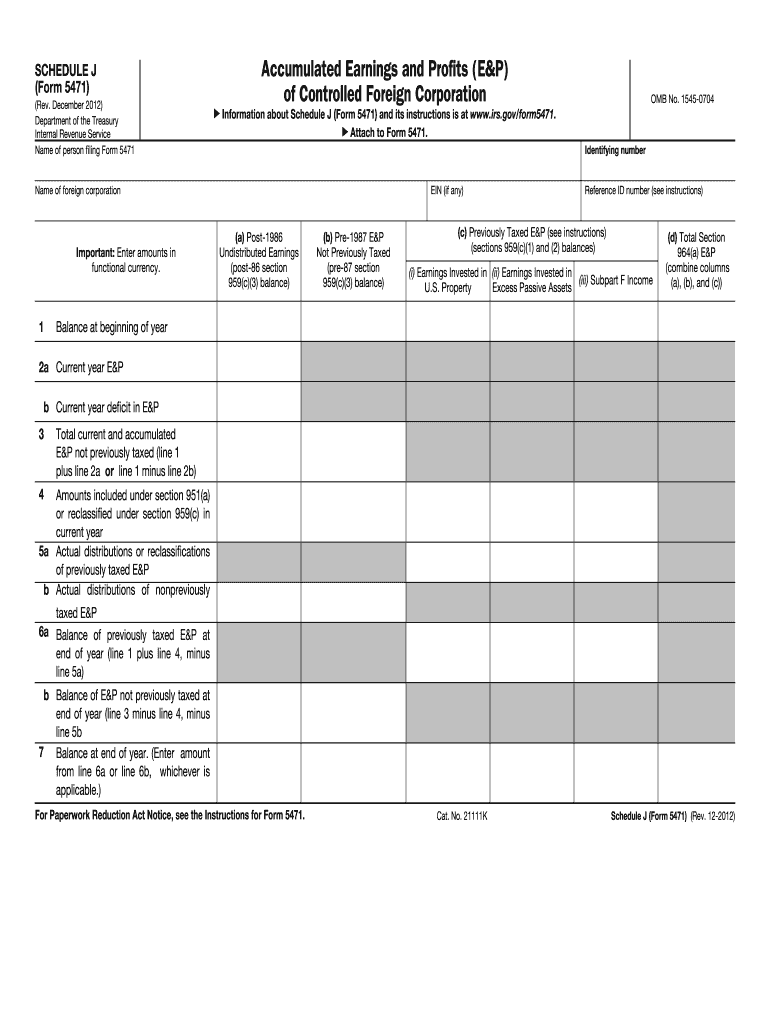

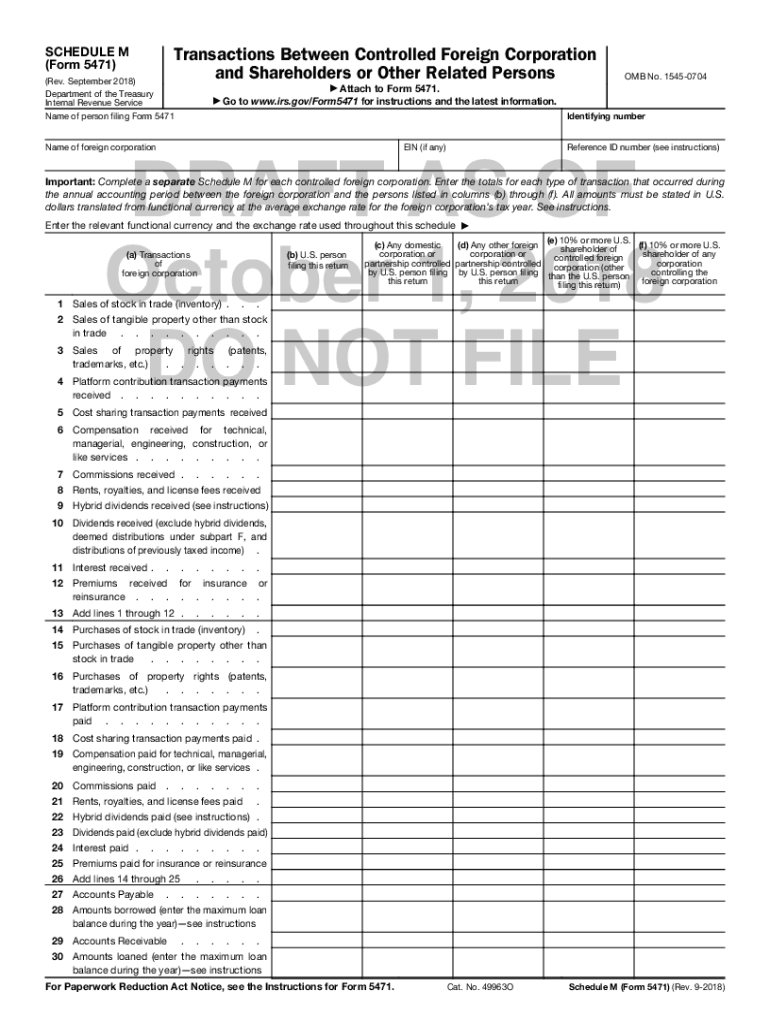

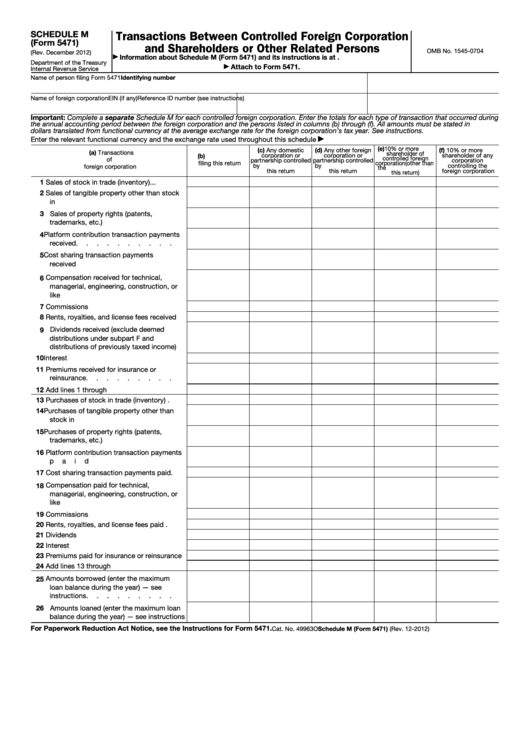

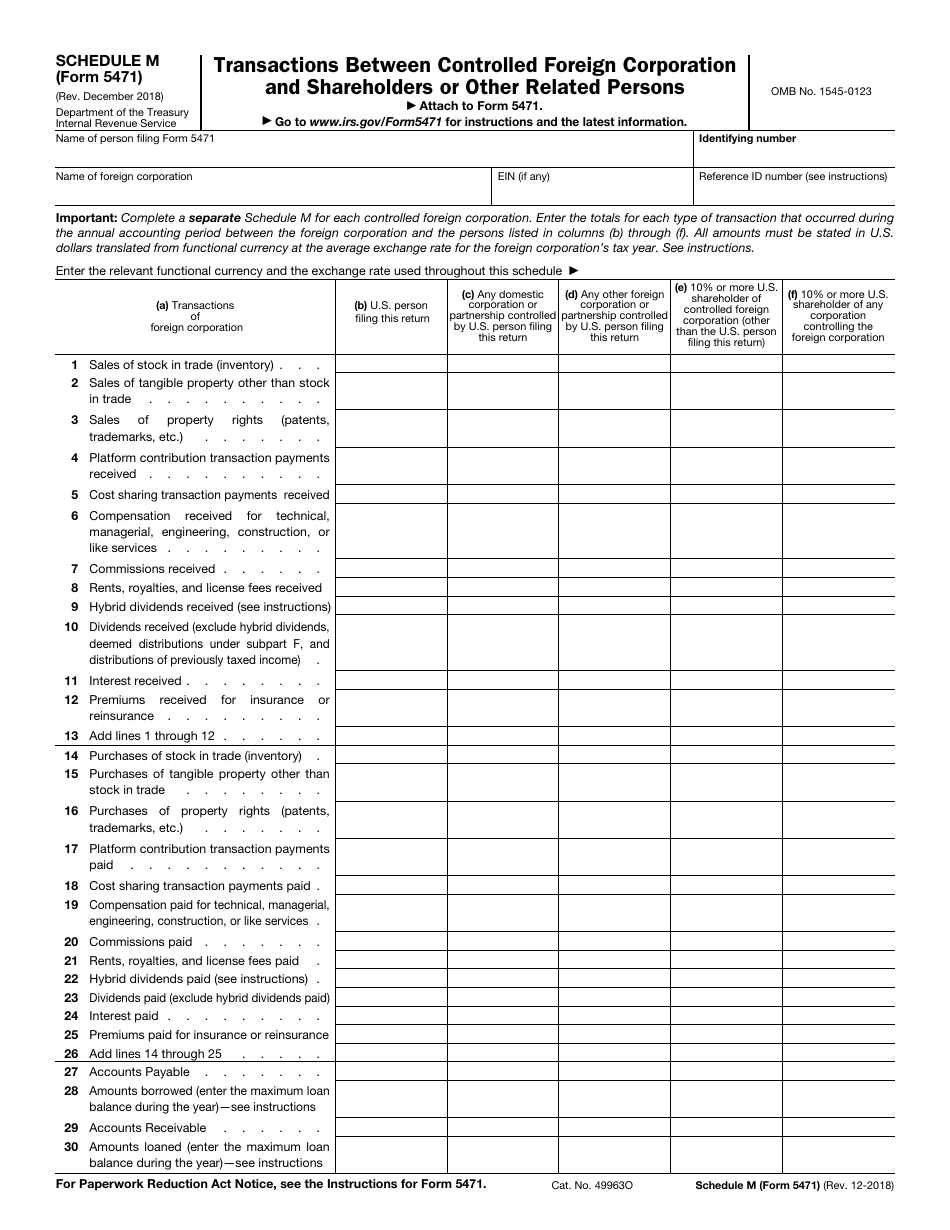

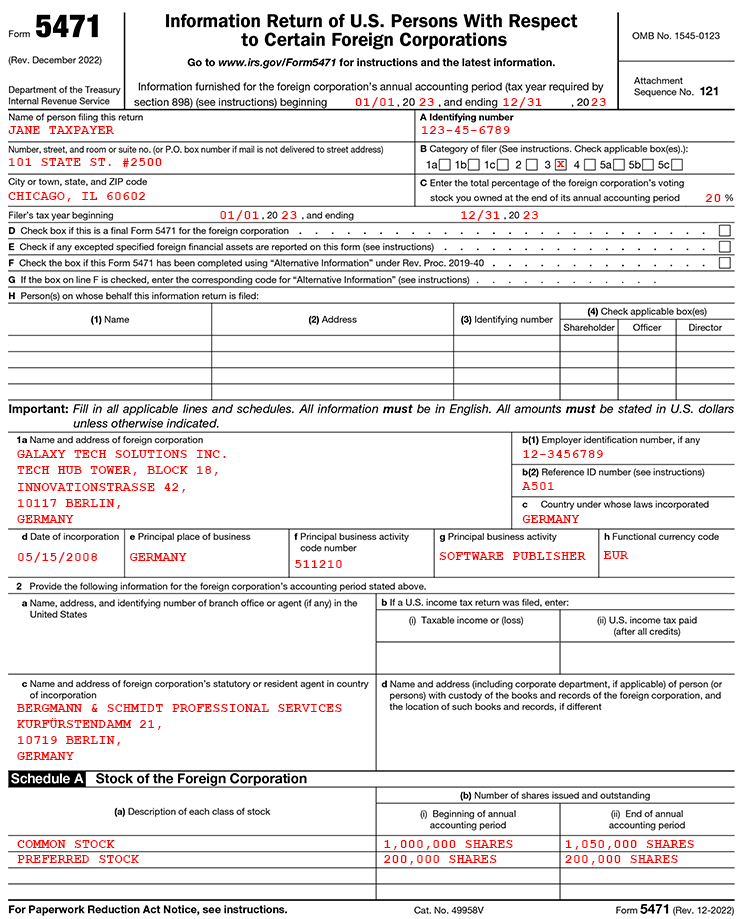

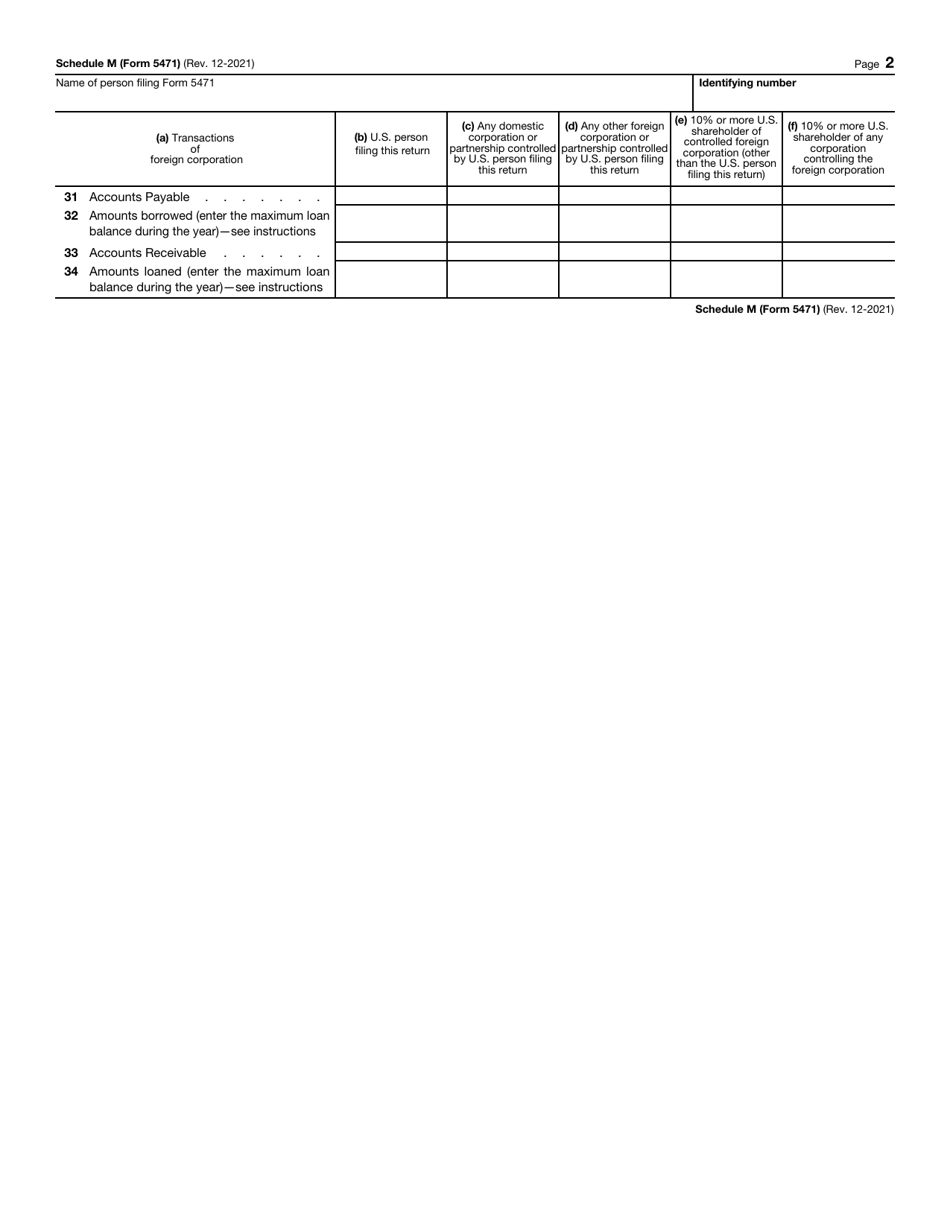

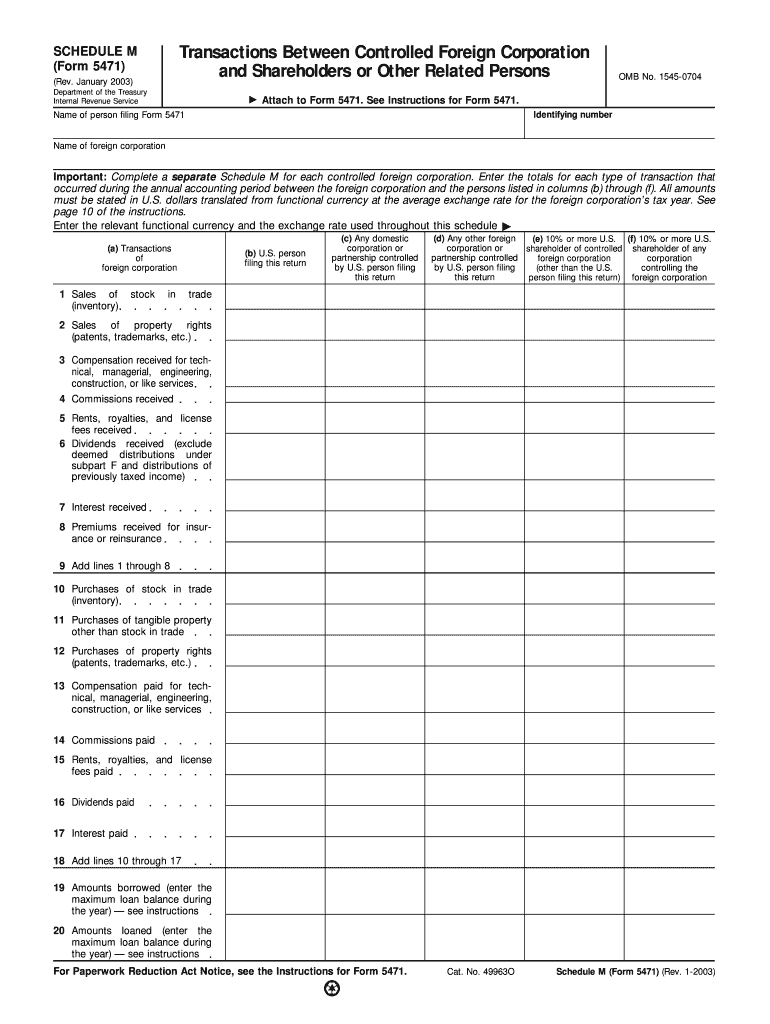

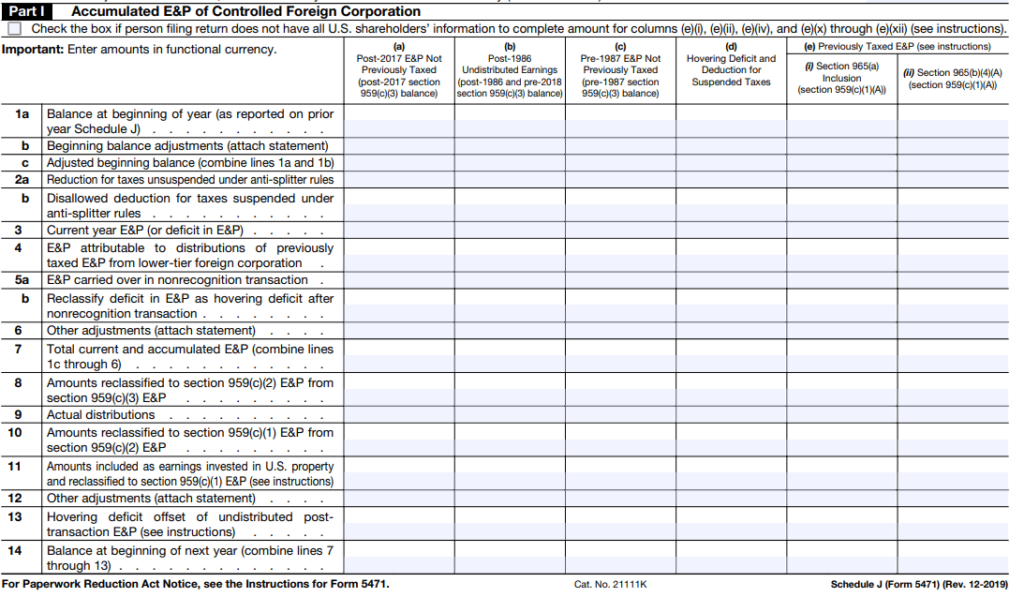

Schedule M Form 5471 - Any person required to file form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for them may be subject to. Citizens and residents who are officers, directors, or shareholders in certain foreign corporations file form 5471 and schedules. Enter the totals for each type of transaction that occurred during the. During a tas compute, the u.s. Dollar balance after tax reclass amounts from the working trial balance flow to the form 5471 schedule m. Schedule m requires the majority u.s. Complete a separate schedule m for each controlled foreign corporation. Owner to provide information on transactions between the cfc and its shareholders or other.

Any person required to file form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for them may be subject to. Enter the totals for each type of transaction that occurred during the. Complete a separate schedule m for each controlled foreign corporation. Schedule m requires the majority u.s. During a tas compute, the u.s. Dollar balance after tax reclass amounts from the working trial balance flow to the form 5471 schedule m. Citizens and residents who are officers, directors, or shareholders in certain foreign corporations file form 5471 and schedules. Owner to provide information on transactions between the cfc and its shareholders or other.

Enter the totals for each type of transaction that occurred during the. Dollar balance after tax reclass amounts from the working trial balance flow to the form 5471 schedule m. Complete a separate schedule m for each controlled foreign corporation. Schedule m requires the majority u.s. Citizens and residents who are officers, directors, or shareholders in certain foreign corporations file form 5471 and schedules. Owner to provide information on transactions between the cfc and its shareholders or other. During a tas compute, the u.s. Any person required to file form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for them may be subject to.

5471 schedule m Fill out & sign online DocHub

Enter the totals for each type of transaction that occurred during the. Owner to provide information on transactions between the cfc and its shareholders or other. During a tas compute, the u.s. Citizens and residents who are officers, directors, or shareholders in certain foreign corporations file form 5471 and schedules. Any person required to file form 5471 and schedule j,.

Fillable Online Form 5471 (Schedule M) (Rev. September 2018

Dollar balance after tax reclass amounts from the working trial balance flow to the form 5471 schedule m. Schedule m requires the majority u.s. Complete a separate schedule m for each controlled foreign corporation. Owner to provide information on transactions between the cfc and its shareholders or other. During a tas compute, the u.s.

Fillable Form 5471 Schedule M Transactions Between Controlled

Citizens and residents who are officers, directors, or shareholders in certain foreign corporations file form 5471 and schedules. Owner to provide information on transactions between the cfc and its shareholders or other. During a tas compute, the u.s. Dollar balance after tax reclass amounts from the working trial balance flow to the form 5471 schedule m. Schedule m requires the.

IRS Form 5471 Schedule M Fill Out, Sign Online and Download Fillable

Complete a separate schedule m for each controlled foreign corporation. Schedule m requires the majority u.s. Any person required to file form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for them may be subject to. Enter the totals for each type of transaction that occurred during the. Dollar balance.

Form 5471 Overview Who, What, and How Gordon Law Group Experienced

Citizens and residents who are officers, directors, or shareholders in certain foreign corporations file form 5471 and schedules. During a tas compute, the u.s. Dollar balance after tax reclass amounts from the working trial balance flow to the form 5471 schedule m. Complete a separate schedule m for each controlled foreign corporation. Any person required to file form 5471 and.

The Tax Times IRS Issues Updated New Form 5471 What's New?

Dollar balance after tax reclass amounts from the working trial balance flow to the form 5471 schedule m. Enter the totals for each type of transaction that occurred during the. During a tas compute, the u.s. Complete a separate schedule m for each controlled foreign corporation. Schedule m requires the majority u.s.

IRS Form 5471 Schedule M Download Fillable PDF or Fill Online

Complete a separate schedule m for each controlled foreign corporation. Owner to provide information on transactions between the cfc and its shareholders or other. Any person required to file form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for them may be subject to. Citizens and residents who are officers,.

Form 5471 Schedule M Complete with ease airSlate SignNow

During a tas compute, the u.s. Complete a separate schedule m for each controlled foreign corporation. Owner to provide information on transactions between the cfc and its shareholders or other. Schedule m requires the majority u.s. Enter the totals for each type of transaction that occurred during the.

Instructions on Tax form 5471 TaxForm5471

Schedule m requires the majority u.s. Any person required to file form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for them may be subject to. Complete a separate schedule m for each controlled foreign corporation. Citizens and residents who are officers, directors, or shareholders in certain foreign corporations file.

Form 5471 (Schedule M) Transactions between Controlled Foreign

Enter the totals for each type of transaction that occurred during the. Any person required to file form 5471 and schedule j, m, or o who agrees to have another person file the form and schedules for them may be subject to. Owner to provide information on transactions between the cfc and its shareholders or other. Schedule m requires the.

Any Person Required To File Form 5471 And Schedule J, M, Or O Who Agrees To Have Another Person File The Form And Schedules For Them May Be Subject To.

Citizens and residents who are officers, directors, or shareholders in certain foreign corporations file form 5471 and schedules. Enter the totals for each type of transaction that occurred during the. Schedule m requires the majority u.s. Complete a separate schedule m for each controlled foreign corporation.

During A Tas Compute, The U.s.

Dollar balance after tax reclass amounts from the working trial balance flow to the form 5471 schedule m. Owner to provide information on transactions between the cfc and its shareholders or other.