Tax Form 56 - It looks like i have to file two. It authorizes you to act as if you’re. Level 3 to which address should form 56 be sent? After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? Form 56 filing the final tax returns for my late father. You may also need form 56, which is used when either setting up or terminating a fiduciary relationship.

You may also need form 56, which is used when either setting up or terminating a fiduciary relationship. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. Form 56 filing the final tax returns for my late father. It looks like i have to file two. It authorizes you to act as if you’re. Level 3 to which address should form 56 be sent? Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust?

After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. Form 56 filing the final tax returns for my late father. It looks like i have to file two. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. It authorizes you to act as if you’re. Level 3 to which address should form 56 be sent? Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? You may also need form 56, which is used when either setting up or terminating a fiduciary relationship.

IRS Form 56 Walkthrough (Notice of Fiduciary Relationship) YouTube

It looks like i have to file two. It authorizes you to act as if you’re. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? Form 56 filing the final tax returns for my late father. Form 56, authority for non probate executor hello, i filed a final tax.

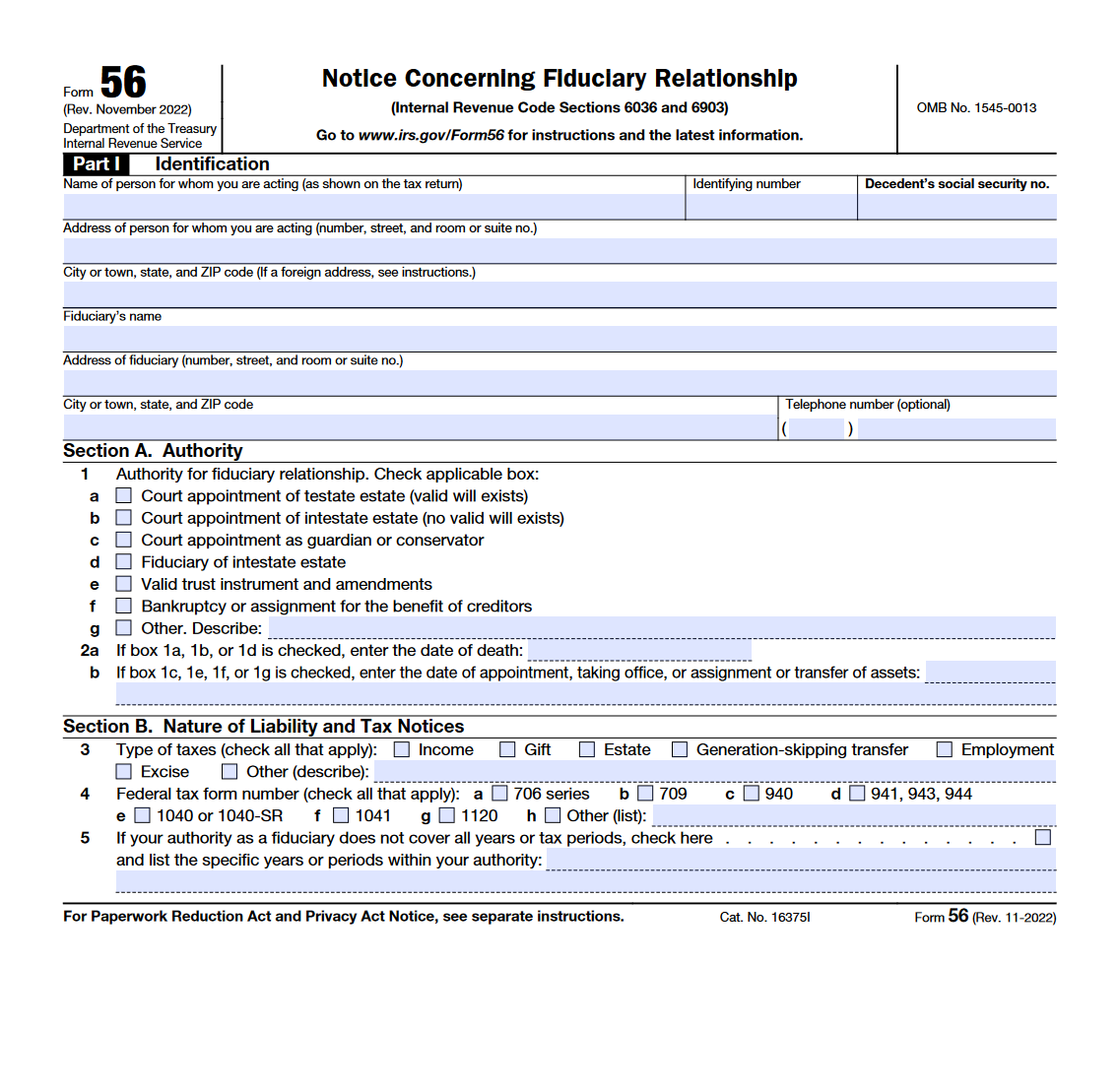

IRS Form 56. Notice Concerning Fiduciary Relationship Forms Docs 2023

Level 3 to which address should form 56 be sent? Form 56 filing the final tax returns for my late father. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. You may also need form 56, which is used when either setting up or terminating a.

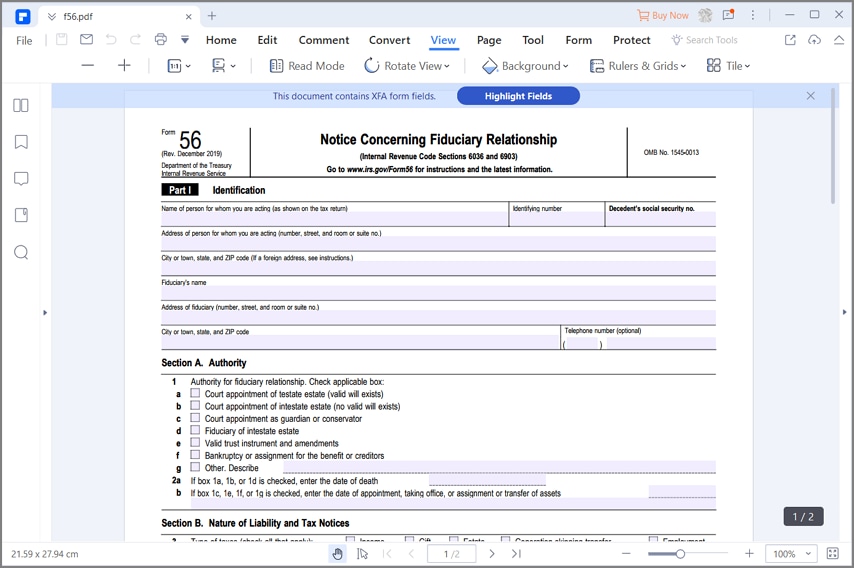

IRS Form 56 A Guide to IRS Fiduciary Relationships

You may also need form 56, which is used when either setting up or terminating a fiduciary relationship. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? It authorizes you to act as if you’re. After taking care of my elderly father, he passed away oct 2021 and i.

Form 56

It authorizes you to act as if you’re. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? You may also need form 56, which is used when either setting up or terminating a fiduciary relationship. Form 56 filing the final tax returns for my late father. Form 56, authority.

IRS Form 56 You can Fill it with the Best Form Filler

It looks like i have to file two. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? You may also need form 56, which is used when either setting up or terminating a fiduciary relationship. Form 56, authority for non probate executor hello, i filed a final tax return.

Form 56 Fill out & sign online DocHub

Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. It authorizes you to act as if you’re. Level 3 to which address should form 56 be sent? Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a.

Form 56 Notice Concerning Fiduciary Relationship

After taking care of my elderly father, he passed away oct 2021 and i am now his fiduciary. It authorizes you to act as if you’re. It looks like i have to file two. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? Form 56 filing the final tax.

Form 56 IRS Template Notice Concerning Fiduciary Relationship

It looks like i have to file two. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? It authorizes you to act as if you’re. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. You.

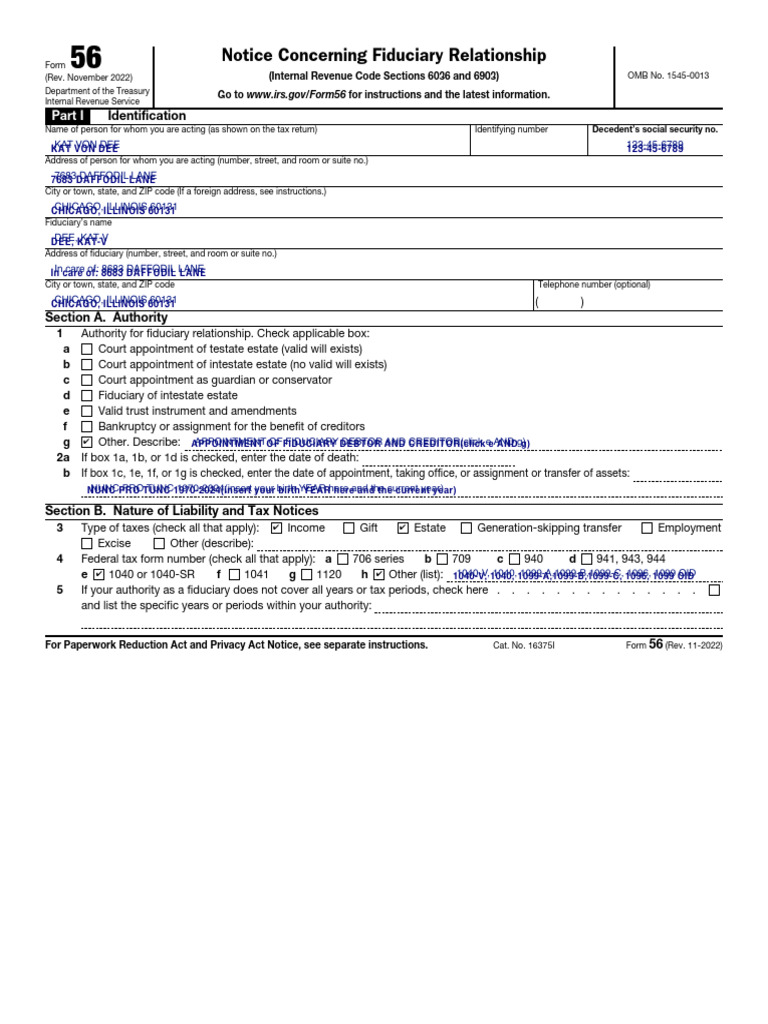

Sample Form 56 PDF Taxes Fiduciary

Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? It looks like i have to file two. Form 56 filing the final tax returns for my late father. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on.

IRS Form 56F Instructions Fiduciary of a Financial Institution

Form 56 filing the final tax returns for my late father. Form 56, authority for non probate executor hello, i filed a final tax return for my deceased mother who passed on august 2021. Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? You may also need form 56,.

Form 56, Authority For Non Probate Executor Hello, I Filed A Final Tax Return For My Deceased Mother Who Passed On August 2021.

Level 4 is a form 56 (notice concerning fiduciary relationship) required to be filed by a trustee of a trust? It looks like i have to file two. It authorizes you to act as if you’re. You may also need form 56, which is used when either setting up or terminating a fiduciary relationship.

After Taking Care Of My Elderly Father, He Passed Away Oct 2021 And I Am Now His Fiduciary.

Level 3 to which address should form 56 be sent? Form 56 filing the final tax returns for my late father.