What Is A 1098T Tax Form Used For - The stipend income is reported on a w2 since that is my only income and i got one from. Open or continue your return. Credits go to the parents, income to the students. After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed. In box 5 (my total number of. I am a grad student who receives a stipend. Parents for credit, student for income.

After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed. Parents for credit, student for income. I am a grad student who receives a stipend. The stipend income is reported on a w2 since that is my only income and i got one from. Open or continue your return. In box 5 (my total number of. Credits go to the parents, income to the students.

Credits go to the parents, income to the students. I am a grad student who receives a stipend. Open or continue your return. After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed. In box 5 (my total number of. The stipend income is reported on a w2 since that is my only income and i got one from. Parents for credit, student for income.

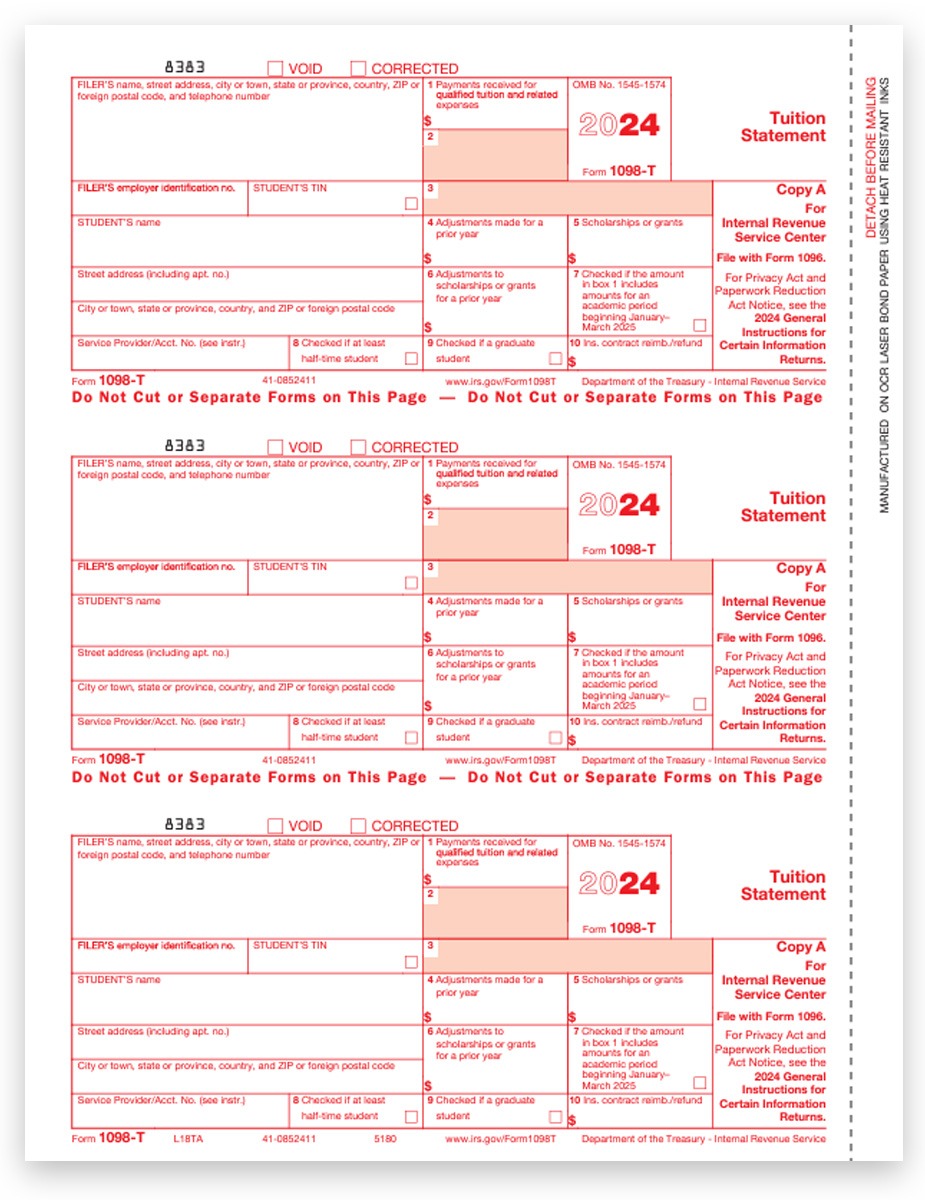

1098T Recipient Copy Pressure Seal Form (1098T)

Open or continue your return. In box 5 (my total number of. The stipend income is reported on a w2 since that is my only income and i got one from. Parents for credit, student for income. Credits go to the parents, income to the students.

Form 1098T 2024 2025

Open or continue your return. In box 5 (my total number of. The stipend income is reported on a w2 since that is my only income and i got one from. After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed. I am a grad student who receives a.

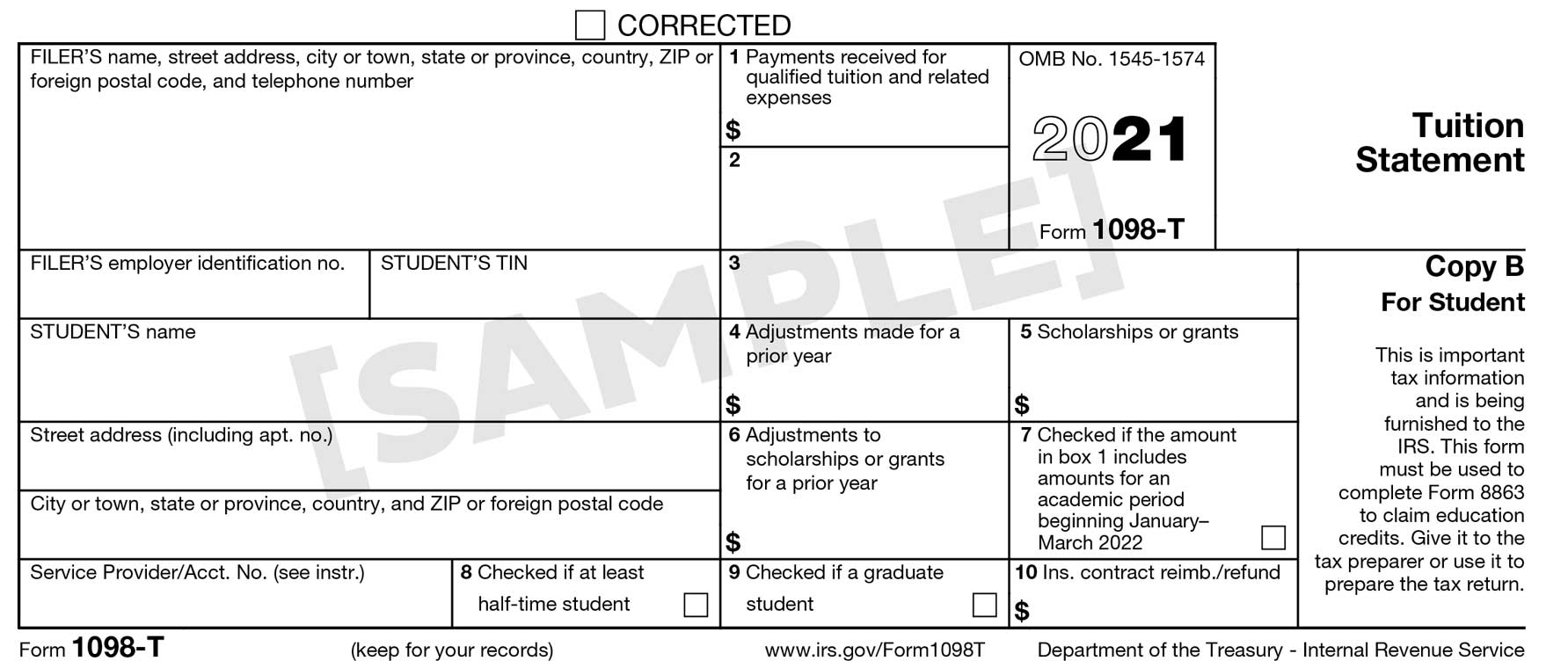

1098T IRS Tax Form Instructions 1098T Forms

After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed. The stipend income is reported on a w2 since that is my only income and i got one from. Open or continue your return. I am a grad student who receives a stipend. In box 5 (my total number.

Tax Information Spartan Central

Credits go to the parents, income to the students. I am a grad student who receives a stipend. The stipend income is reported on a w2 since that is my only income and i got one from. Open or continue your return. In box 5 (my total number of.

Form 1098 Instructions 2024 Sonni Olympe

Credits go to the parents, income to the students. Open or continue your return. After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed. Parents for credit, student for income. The stipend income is reported on a w2 since that is my only income and i got one from.

Understanding What Is 1098T Form

Parents for credit, student for income. After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed. Open or continue your return. Credits go to the parents, income to the students. The stipend income is reported on a w2 since that is my only income and i got one from.

1098 T Form Printable

Open or continue your return. After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed. In box 5 (my total number of. Credits go to the parents, income to the students. The stipend income is reported on a w2 since that is my only income and i got one.

Free Printable 1098 Form Printable Forms Free Online

I am a grad student who receives a stipend. Parents for credit, student for income. Open or continue your return. The stipend income is reported on a w2 since that is my only income and i got one from. Credits go to the parents, income to the students.

Free Printable 1098 T Form Free Printables Hub

In box 5 (my total number of. After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed. Open or continue your return. Credits go to the parents, income to the students. Parents for credit, student for income.

Fillable Online 1098T Tax Form Sample Fax Email Print pdfFiller

The stipend income is reported on a w2 since that is my only income and i got one from. After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed. I am a grad student who receives a stipend. Credits go to the parents, income to the students. Open or.

Credits Go To The Parents, Income To The Students.

In box 5 (my total number of. The stipend income is reported on a w2 since that is my only income and i got one from. I am a grad student who receives a stipend. After entering 1098t and education expenses, turbo tax says my son's education assistance counts as income and need to be filed.

Open Or Continue Your Return.

Parents for credit, student for income.